Buy Now, Pay Later Has Been Around for a While. Why Is It Exploding Now?

InnovationBuy Now, Pay Later

The past year has spurred consumers across the globe to shift their behaviors and expectations on many fronts – and how they want to pay for goods and services is proving to be no exception. In the wake of the pandemic, the buy now, pay later (BNPL) market is booming thanks to the flexibility it provides consumers who prefer to make predictable installment payments for their purchases without incurring interest and in some cases, without impacting their credit rating.

“Buy now, pay later is not a new concept, but as with anything, timing is everything,” said Doug Bland, Senior Vice President and General Manager of Global Credit at PayPal. “The industry saw explosive growth, and we knew that we needed to think about PayPal’s flexible payment options to help fuel and benefit from this growth.”

This led PayPal to launch several BNPL offerings globally, including 4x Paiement in France, Pay in 3 in the United Kingdom, and Pay in 4 in the United States. Large Enterprise brands across industries have adopted these offerings, including fashion, retail, travel, and more. Based on the positive response from consumers and merchants alike, PayPal has already announced it will roll out Pay in 4 in Australia in early June 2021.

The growing demand for flexible payment offerings is clear. In the first six months after PayPal introduced Pay in 4 in the U.S., the product has skyrocketed in popularity, driving $1 billion in total payment volume for the company.1 “We’ve seen average order volumes more than double when compared to PayPal purchases that don’t use pay later…and merchants don’t pay anything additional to reap these benefits,” Bland said.

So, what’s causing the soaring demand?

Uncertainty around employment and finances has helped drive the growth in the BNPL space. And in 2020, people increasingly used the option to spread out lower-cost necessities – not just large purchases. Even consumers with financial resources have been seeking responsible ways to finance purchases without incurring fees.

Paying for purchases in increments is a natural fit for what he calls the “subscription lifestyle,” in which consumers are used to paying in set amounts, versus all upfront. Examples of this lifestyle include paying monthly fees for streaming services, curated wardrobes and more. Younger customers in this group, in particular, “are gravitating to pay later services now more than ever,” Bland said. “[BNPL] financing options fit neatly into the lifestyle consumers are already living.”

It’s not a surprise, then, that while there has been increased interest across demographics, more than a third of Pay in 4 sales are from consumers under age 30. “It’s really been fantastic to see our customers not just adopt, but love a product so much,” Bland said. To that point, 50% of customers who used PayPal’s BNPL products used them again within three months; within six months, 70% of customers used BNPL again.1

Buy now, pay later drives sales – but retailers may miss out due to their misconceptions

Along with giving shoppers an option they want in the moment, research suggests BNPL also has the power to drive sales and customer loyalty for retailers. A recent study from Forrester, commissioned by PayPal, surveyed both consumers and merchants to gain more insight into BNPL usage. It found that among the business-to-consumer (B2C) merchants polled, 21% of sales come from BNPL options.2

Another study from Netfluential and PayPal found that among consumers between ages 18-39, 28% were more likely to shop at a merchant again if it offered a BNPL option, and 32% would make purchases they would’ve otherwise postponed.3 “This is huge in an era where marketplaces dominate, and businesses have challenges differentiating themselves from their competition,” Bland said. “If using a commerce tool like pay later can increase consumer loyalty, it moves from a must-have to a foundational customer experience.”

In the Netfluential study, 24% of consumers also said they could shop for more expensive items based on the availability of BNPL options.2 The Forrester research echoes this, with younger consumers reporting they use BNPL to finance big-ticket purchases. Seven in 10 said they’re likely to use it for large items like furniture or other purchases over $1,000.2

Bland points out that by giving customers the flexibility to buy more expensive items, BNPL can also drive revenue growth and shopper loyalty for retailers. Still, some retailers are hesitant to adopt BNPL options, in part because of a belief that younger shoppers are reluctant to use credit to make purchases.

The reality is that this is a misconception. The Forrester data found that 48% of those in Generation Z, between ages 18-22, said they are comfortable or extremely comfortable using credit. The numbers go up from there: 60% of younger Millennials, ages 23-29, and 69% of older Millennials, ages 30-39, report feeling the same way. Credit is also currently the most popular payment method for Millennials, and younger Gen Z consumers are warming to it, too. In the same poll, 67% of Gen Z and Millennial consumers said they used credit in the prior week.2

Some retailers also misunderstand the motivations behind using BNPL options specifically. For younger consumers, for example, the most important reason cited was the ability to have no interest for a period of time, according to the Forrester research. But when B2C merchants were asked what they see as the driving factor, they ranked that reason fifth out of seven possible options.

“This idea of younger consumers being credit-shy is just not the reality of these generations,” Bland said. “Merchants are underestimating the power of buy now, pay later services to reach Millennial and Gen Z consumers, as well as older generations of consumers who are becoming more comfortable shopping online coming out of the pandemic.”

Simpler terms, trust, and timing can help retailers seize opportunity

Retailers that have hesitated to adopt BNPL can still catch up, especially during back-to-school and fall shopping seasons when younger shoppers, in particular, maybe on the hunt for high-dollar items like computers or home furnishings.

“What we know is that credit, as a construct, is not what these younger generations have issues with – their concern is with the hidden or complicated terms,” Bland said. “With most BNPL products, like PayPal’s, the terms are very straightforward, and we do everything we can to help a user remain in good standing while using the product.”

For example, in the US when someone wants to use Pay in 4, they select their repayment method upfront and see the schedule of payments, so they know when repayments will occur. “These features provide a clarity around areas of the product and [help shoppers] make a more informed decision to utilize it,” Bland said.

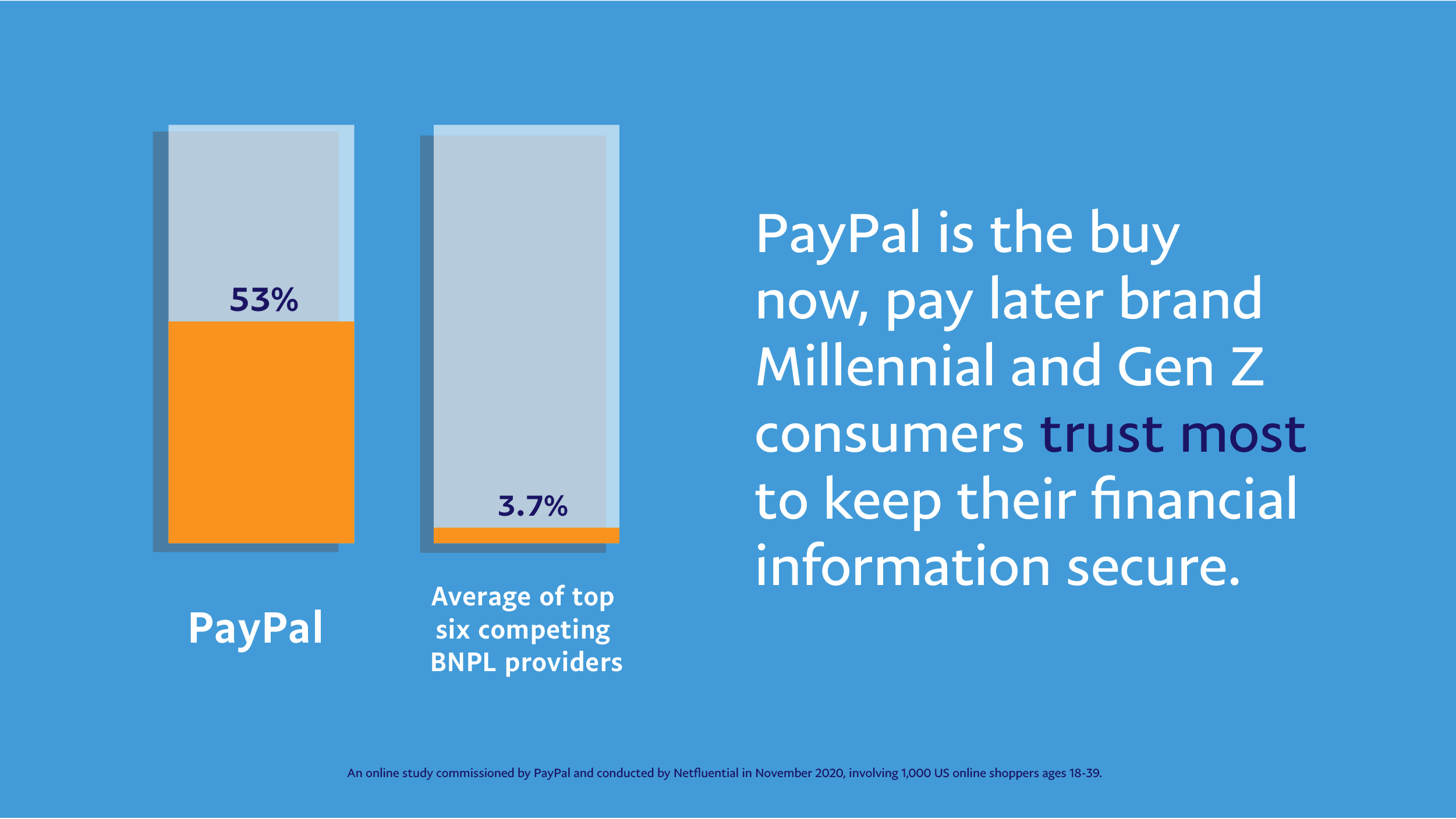

Trust is also a major factor for consumers when choosing which payment method to use, so it should matter to retailers, too. According to Netfluential’s research, 79% of consumers cited “trusting their financial information is secure” as the top factor when paying online. Similarly, 71% said they’re more likely to trust businesses that offer their preferred payment method.3 For its part, PayPal is the most trusted BNPL brand among Millennials and Gen Z consumers, based on Netfluential’s findings.

As retailers navigate re-openings and the post-pandemic recovery, staying abreast of how consumers want to pay will be essential. “It’s pretty clear that having a BNPL option for consumers is not something that will vanish as we emerge from the pandemic. These options are now ingrained as a payment option for consumers and necessary for retailers to engage customers and convert purchases,” said Bland.

1 PayPal Q4 2020 Earnings Call. Includes Buy Now Pay Later, Q4 2020 results for US, FR, UK and DE Installments.

2 A commissioned study conducted by Forrester Consulting on behalf of PayPal in May 2020, involving 504 U.S. consumers ages 18-39.

3 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 U.S. online shoppers ages 18-39.