ProductPayPal

Dan Leberman, SVP, SMB and Partners

We are making changes to our published rates in the United States to better align our pricing with the value that our products and services provide. Our goal is to be transparent and upfront with our customers about the changes. These rates will apply to a portion of our merchant customers in the U.S. beginning August 2, 2021. We began notifying some customers today, and you can find a notice on our Policy Updates page.

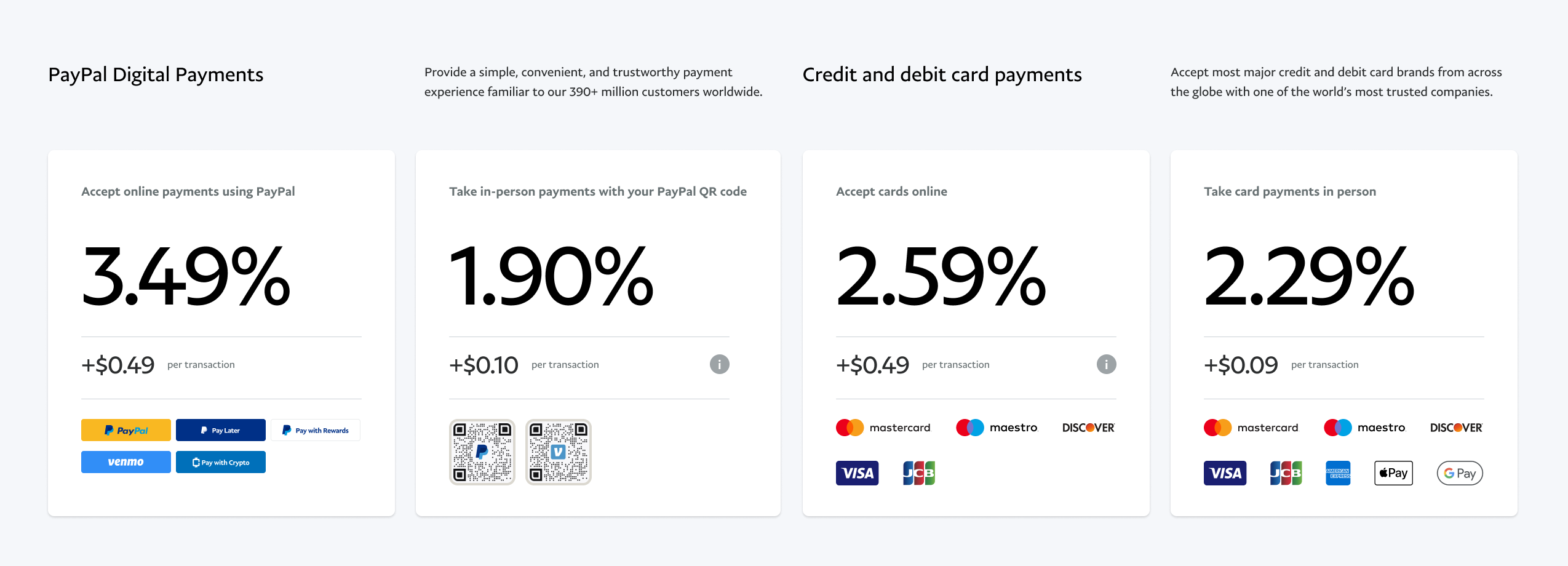

- PayPal Digital Payments: For PayPal payment products (such as PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, Checkout with crypto), which include Seller Protection on eligible transactions, the rate for online transactions will be 3.49% + $0.491 per transaction.

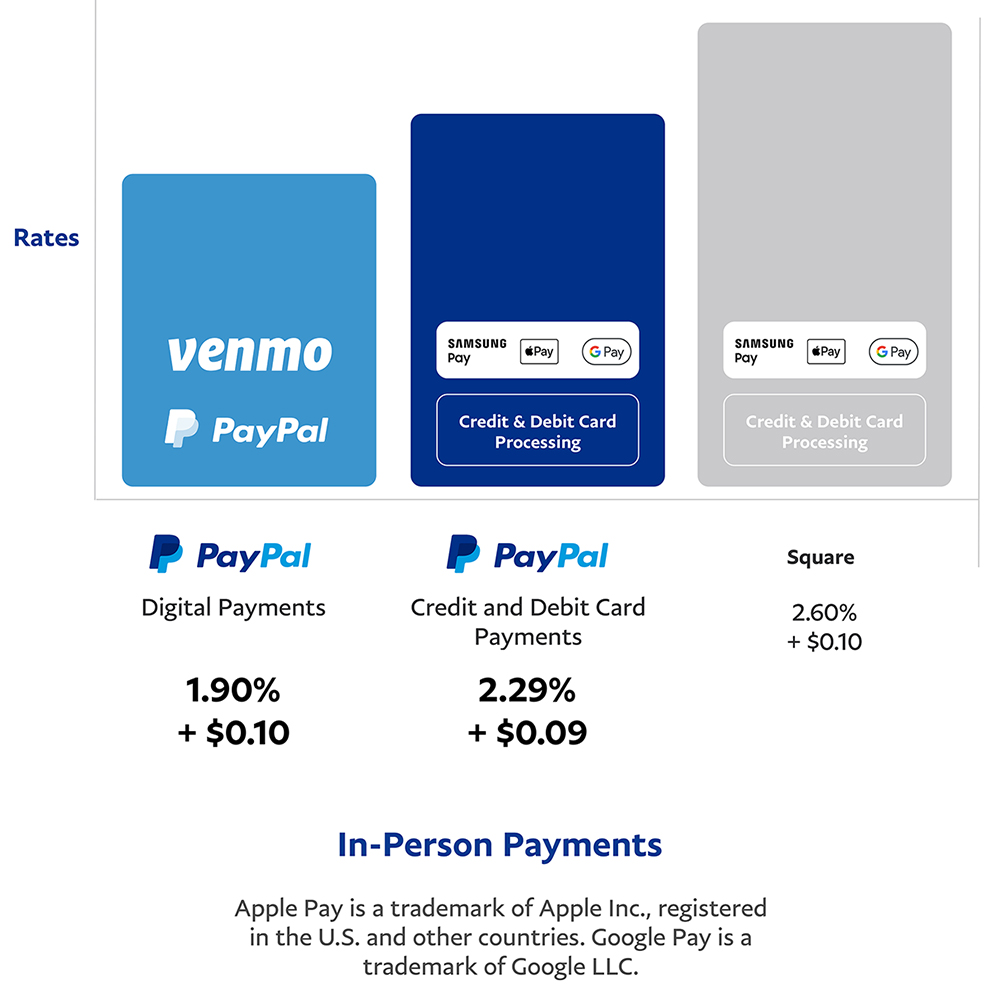

- In-person Payments: For PayPal and Venmo QR code transactions over $10, the rate will be 1.90% + $0.10, and for such transactions $10 and under, the rate will be 2.40% + $0.05. For certain in-person debit and credit transactions the rate will be 2.29% + $0.09.

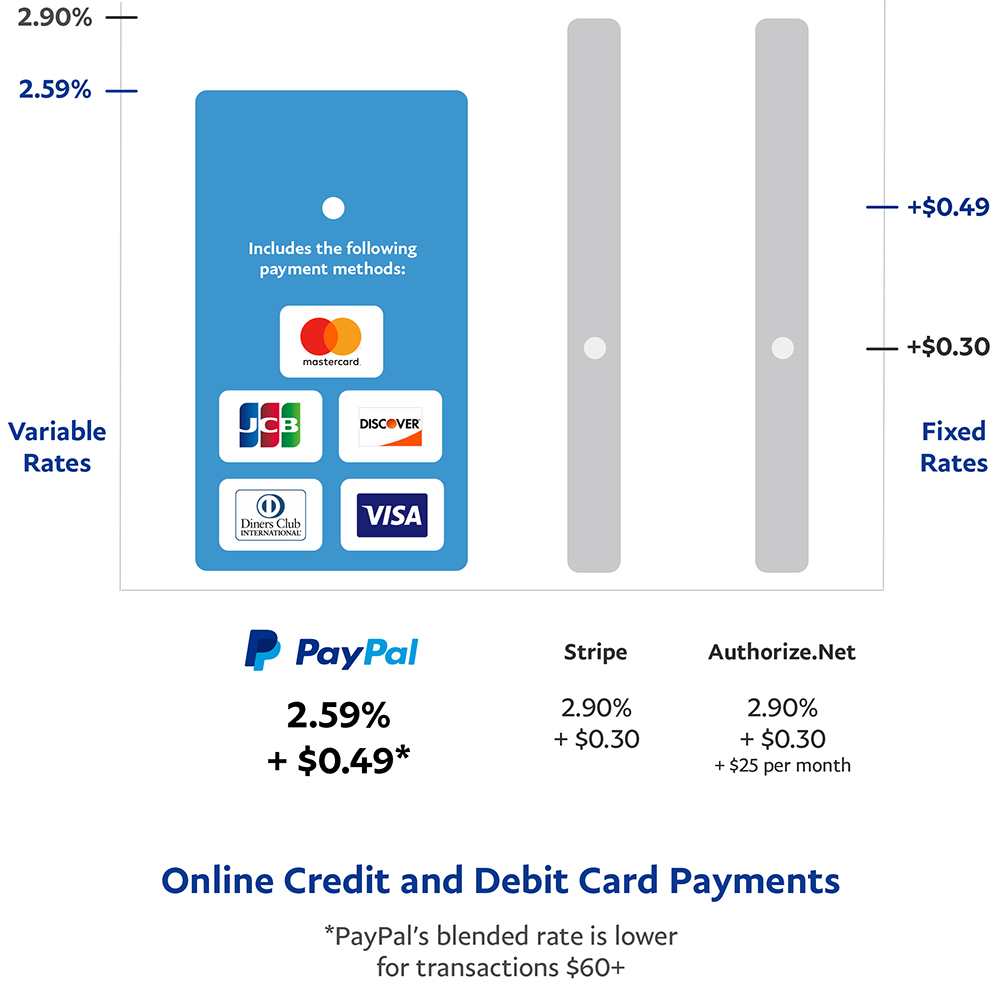

- Credit and Debit Card payments: Online credit and debit card transactions will be 2.59% + $0.491 per transaction without Chargeback Protection, or 2.99% + $0.49 with Chargeback Protection.

- Charity Transactions: Fees for charity transactions will be 1.99% + $0.49 for confirmed charities (subject to application and pre-approval).

- Non-standard Pricing: For U.S. merchants who have custom, non-standard pricing, rates will remain unchanged for those services as agreed.

Why are we making this change?

As PayPal has been evolving our business alongside our merchant business partners, we have accelerated the rollout of products, features, and capabilities, delivering more benefits than ever before. With this, PayPal has become more than just a button or payment processor to be a full commerce platform capable of driving growth for businesses of all sizes online or in person. In fact, our merchant customers benefit from the following:

- Consumers who choose PayPal as a payment method are 60% more likely to convert than consumers who do not choose PayPal as a payment method. 2

- Consumers are nearly three times more likely to complete their purchase when PayPal is available at checkout.3

- Our recently announced Buy Now, Pay Later solutions have resulted in a 15% lift in payment volume for businesses.4

Additionally, we are continuing to partner and invest in our platforms to enhance payment experiences, provide greater choice for the way people pay for goods and services, improve protection and security measures to give people peace of mind when transacting digitally, and improve authorization and conversion rates.

We are continuing to innovate at record pace and empower businesses to never miss a transaction no matter where they do business. By investing in our data analytics capabilities, the improvement of our fraud tools, and the new consumer experiences we are delivering with products like Buy Now and Pay Later, Pay with Rewards Points, and Checkout with crypto – we remain at the cutting edge of payments.

See how our adjusted pricing in the U.S. stacks up to others in the industry, and you can learn more at this SMB pricing page:

Our commitment to our partners – businesses that are the lifeblood of our communities and economy - has never been stronger. We will continue to invest, innovate, and provide businesses with the tools and experiences they need to grow, convert, and retain customers.

For more information about these changes, please visit our PayPal Merchant Fees page and our pricing FAQ.

1 Note that our fixed fees, which depend on the currency for the transaction, will be changing as well. Learn more on our Policy Updates page.

2 comScore online panel commissioned by PayPal, Q4 2017-Q1 2018.

3 Nielsen, Commissioned by PayPal, A Study to understand and measure the impact that PayPal has for U.S.-based LE merchants across different verticals (e.g., health & beauty, travel, fashion) by Nielsen Behavioral Panel of desktop transactions from 15,144 U.S. consumers between July 2020 to September 2020.

4 Early results continue to show a significant 15% engagement lift in transactions and TPV. — PayPal Q2 2021 Earnings