At Venmo, protecting your account, your privacy and preventing scams and fraud is a top priority. With scammers and fraudsters getting more sophisticated in their attempts to gain access to your information, here are some of the most common scams facing consumers and how you can protect yourself, your information, and your Venmo account.

Spotting suspicious emails and texts

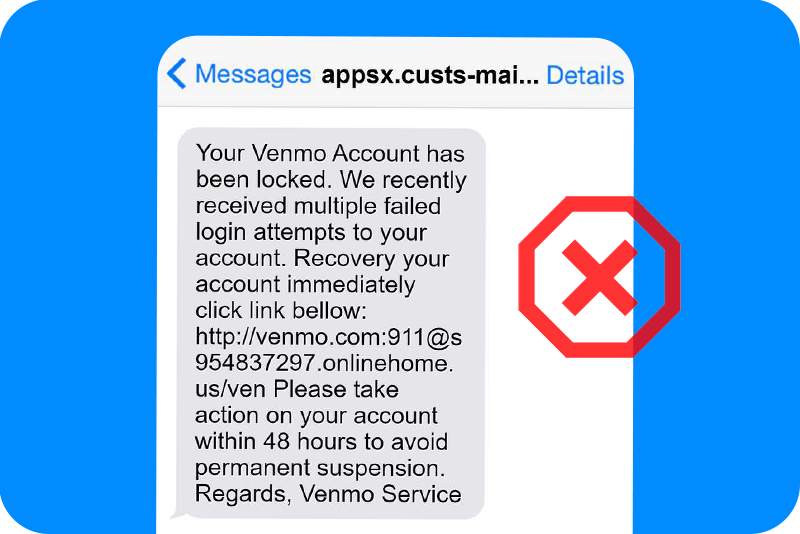

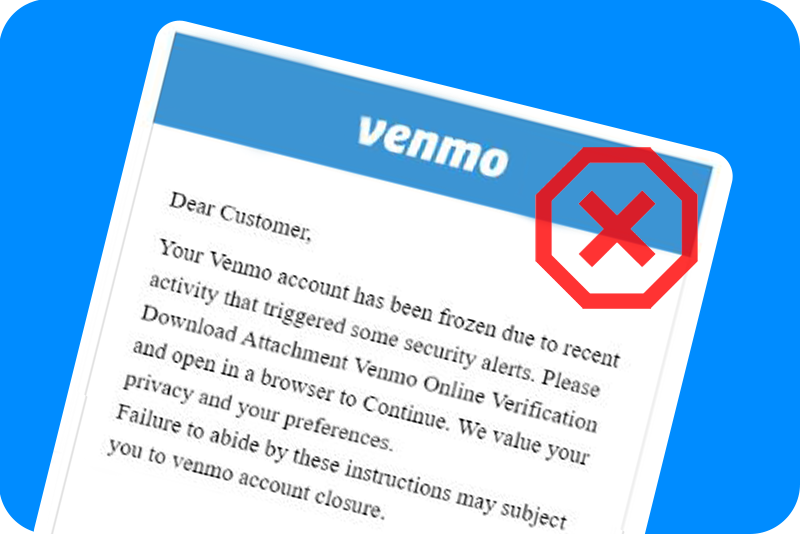

Scammers and fraudsters might try to contact you through phone, email, text message, and more, and might encourage you to log into Venmo using a link the scammer provides rather than using the Venmo app or website. They might even pretend to be calling from Venmo, your bank, or other tech companies. To avoid communicating with scammers, make sure you can identify legitimate communications from Venmo:

- Email communications from Venmo will be sent from a venmo.com email address and all links provided within the email will also direct to a venmo.com address.

- Venmo will never send you a text message reporting a suspicious login on your account. We will never ask you to log in to your Venmo account using a link provided in a text message. Always use the Venmo app or visit www.venmo.com to log in to your account.

- In some cases, Venmo will provide you with a code via text message in order to log in to your account; however, we will never ask you to share that code with us over the phone, email, or text. The code is strictly for your use on the Venmo app or website.

- Venmo will also never ask you to install software on your phone or computer.

- Venmo will also never ask you to send or receive a payment to another user on our behalf, whether it’s to secure your account or to correct a previous payment issue. If someone asks you to take these actions on behalf of Venmo, it is a scam.

- If you think you are the target of a potential scam, we always recommend that you contact Customer Support directly through our website or app, not from other sources or search engine results.

Spotting fraudulent payment requests

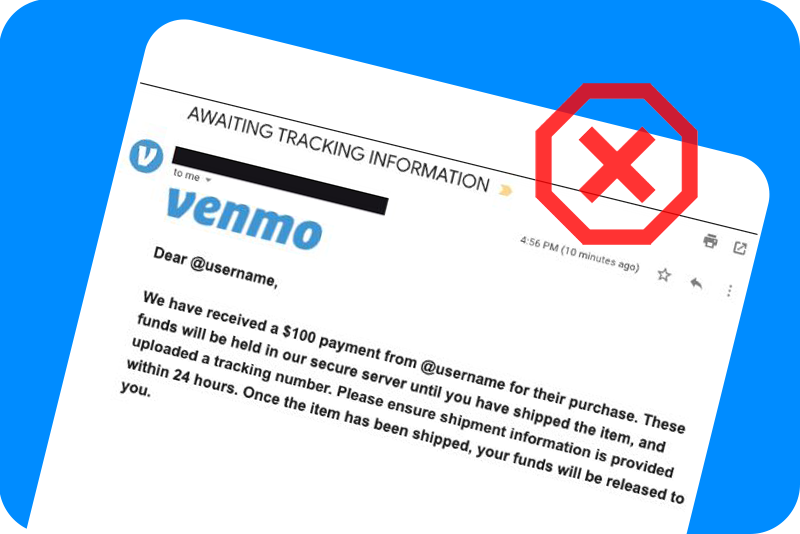

Scammers may also ask you to send or receive payments under a variety of false pretenses. Here are some common indicators to help you determine if a payment request on Venmo is legitimate:

- Use caution when buying goods and services from people you don’t know or selling to people you don’t know on social media platforms. Scammers often sell in-demand items such as electronics and name brand clothing on social media for significant discounts. If their offer is too good to be true, it usually is.

- Do your research and ensure the requesting party is legitimate before proceeding. Scammers on social media may ask you to move a large sum of money for them using Venmo or make large gift card purchases on their behalf.

- Be suspicious of urgent requests to receive or send payments. Scammers use this tactic to prevent you from having time to think rationally and question the legitimacy of a request.

- Use Purchase Protection on Venmo. A stranger selling you something may ask you to complete a purchase on Venmo without turning on the toggle for goods and services in order to avoid the seller transaction fee, but this may leave you vulnerable if the seller does not fulfill their side of the transaction. If the purchase would otherwise be eligible for Venmo’s Purchase Protection, but you didn’t tell us by turning on the toggle that you’re buying a good or service, you won’t be covered under Purchase Protection and you won’t be eligible for a refund. See our Venmo Help Center article about buying and selling on Venmo. We also have a separate article to get you up to speed on which purchases are eligible under Venmo’s Purchase Protection.

Secure your phone and Venmo account

So, you’re out on the town and having a great night – however you may still be targeted by scammers when you’re out in public, even if you’re surrounded by friends and family. Here are some top tips on securing your phone and your Venmo account:

- Be wary of strangers asking to use your phone momentarily; they may be attempting to access sensitive apps and could potentially use your Venmo account to send unauthorized payments without your knowledge.

- Always keep your phone in sight and protect both your phone and the Venmo app with a passcode, Face ID, or fingerprint to prevent unauthorized use. See the Venmo Help Center article about how to set up these security measures.

- Ensure that the people around you cannot see you enter your passcode when unlocking your phone for use, just like entering your debit card PIN at the ATM or a pump at the gas station.

For more information on identifying legitimate Venmo communications, see the Venmo Help Center article about Login Security. For steps on how to handle suspicious communications, see the Venmo Help Center article on reporting fake and suspicious emails. If you have any concerns about a payment request or recent login activity on your account, don’t hesitate to contact our Support team.