In a new report, research shows that PayPal Grant Payments saves time and money for both grant makers and charities by enabling electronic grantmaking and donor information sharing.

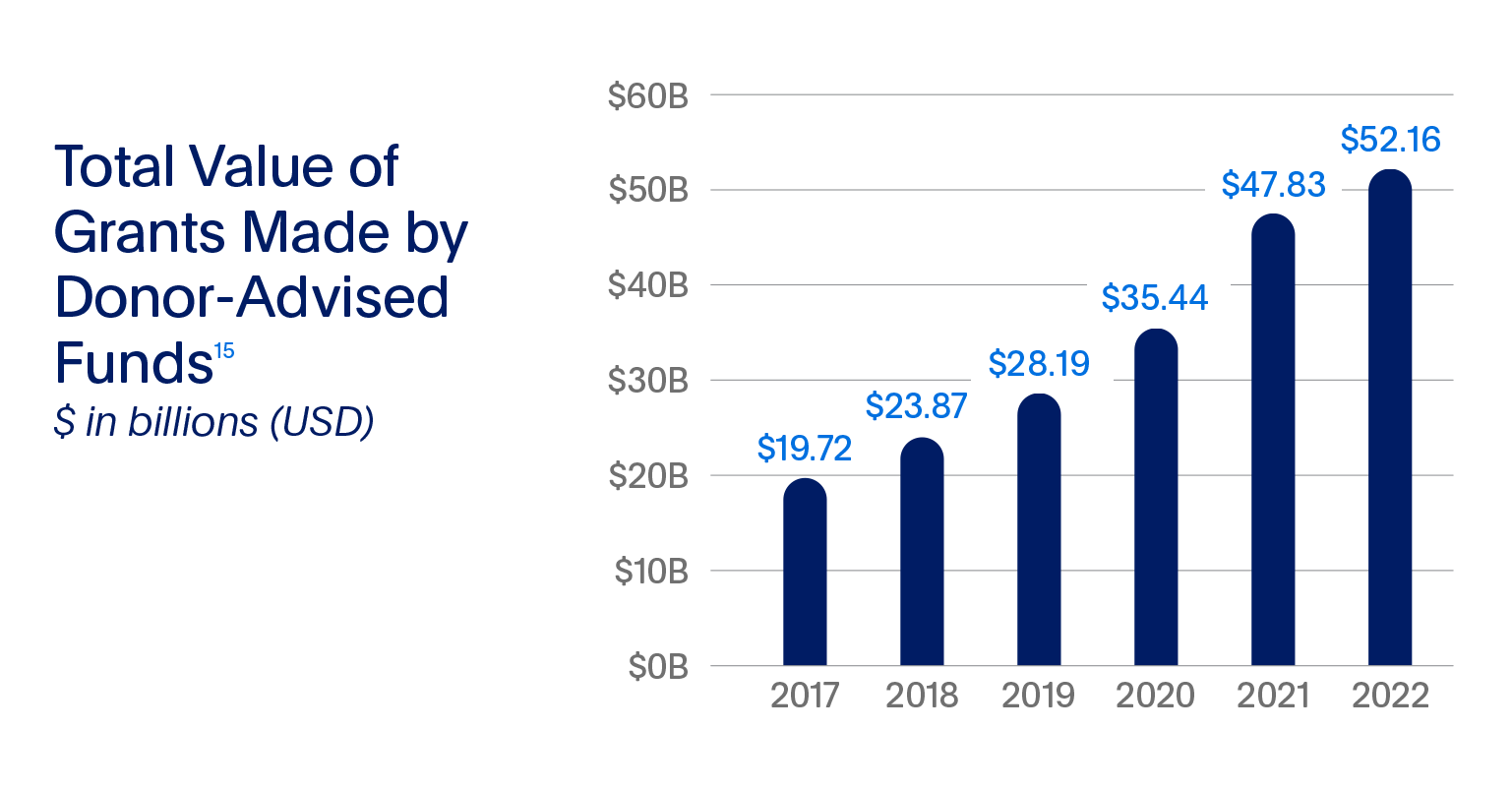

Donors today are increasingly using Donor Advised Funds (DAFs) to distribute funds to charities. These DAFs provide benefits to donors in terms of tax planning, donation best practices, and charity vetting. Grants from DAFs have been growing significantly faster than overall charitable giving over the last few years.

However, grants from DAFs and other institutional grantmakers can create challenges for charities in particular when they send out checks, which can be prone to fraud, take time to arrive, and require manual processing. A multitude of checks from different institutional grantmakers can also make it challenging to identify, attribute, and acknowledge the original donor of the funds.

The survey assessed the potential benefits and drawbacks associated with checks and electronic payment methods. Charities reported that they received over half of their contributions from institutional grantmakers via check. We estimate that institutional grantmakers in aggregate send more than 2 million checks per year to charities.

PayPal Grant Payments helps remove friction

In launching Grant Payments, PayPal hoped to address the challenges charities and grantmakers face in relying on checks. PayPal Grant Payments is a tool that allows grantmakers to distribute funds electronically to vetted charities in a matter of minutes or hours, without having to go through the hassle of acquiring, protecting, and updating charity bank account information — all of which is handled securely by PayPal. For charities, PayPal Grant Payments allows them to receive funds much more quickly, in one place, with clear reporting and donor attribution.

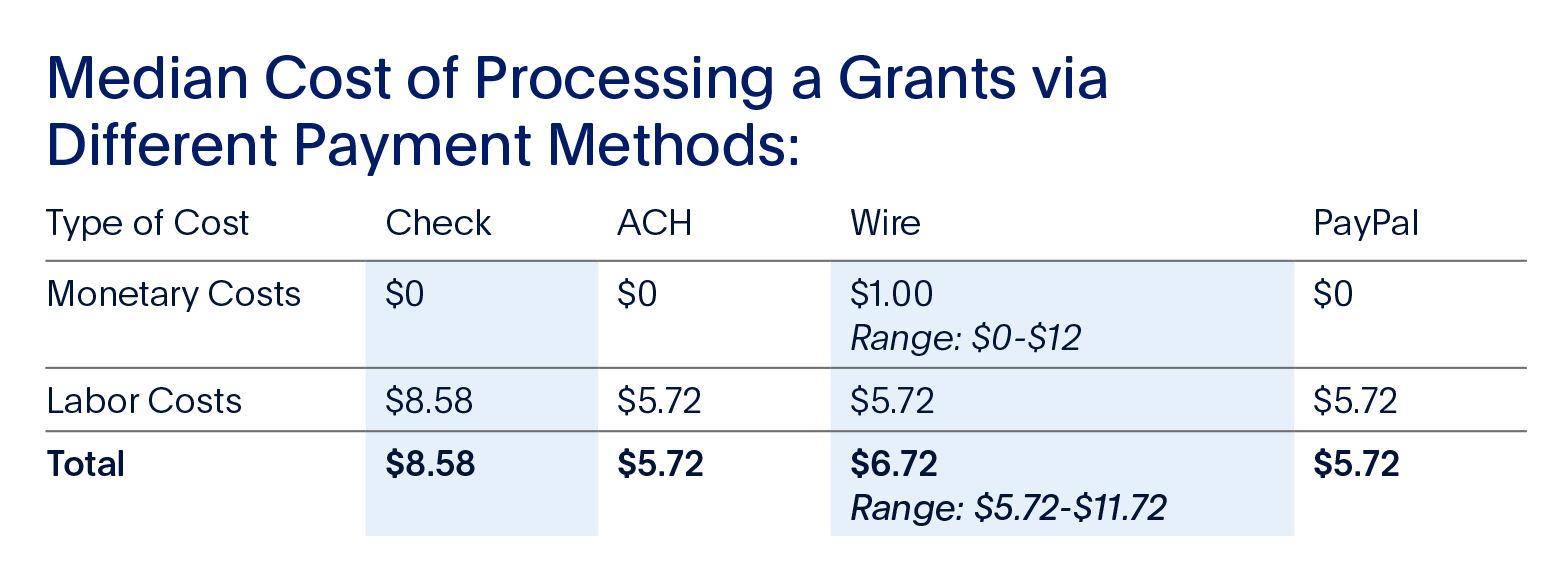

The research study reveals that charities save on average $2.86 per grant when they receive funds via PayPal Grant Payments or ACH, relative to checks. For small charities with annual budgets of less than $1m, the benefits are even more pronounced, saving these organizations on average $7.72 per grant.

An additional benefit of PayPal Grant Payments over ACH is that it only requires the charity to share their bank information once, with a trusted financial services company, rather than individually with each institutional grantmaker. Additionally, Grant Payments consolidates payment and donor information into one secure portal, rather than separating the payment from the donor information as happens with an ACH payment — and which may be provided in different portals for different grantmakers.

Charities only need a confirmed charity account to receive Grant Payments at no cost

By addressing the challenges faced by charities and grantmakers in relying on checks, PayPal Grant Payments provides an alternative electronic payment method that has the potential to save time and money for both parties.

PayPal Confirmed Charities (www.paypal.com/charities) in the U.S. are automatically eligible to receive grants via Grant Payments at no cost to the charity.