Receive Your Paycheck or Economic Impact Payment Through Venmo with Direct Deposit

Venmo

| VENMO

We know now, more than ever, many of you are using Venmo to spend and manage your money. Whether you’re sending payments to support friends, family, and people in your community, or paying for essentials like groceries and bills, we’re here to help.

Having quick and easy access to your money is important, especially in times of uncertainty. That’s why we’ve recently started a phased roll out of Direct Deposit on Venmo, so select users can choose to have their paychecks or economic impact payments (stimulus payments)* sent to their balance with Venmo.

Setting-up Direct Deposit

If you’re eligible to use Direct Deposit, for example, if you have the Venmo debit card, you’ll be able to set up Direct Deposit, so your paychecks or tax refunds,** and even government stimulus payments can be sent to your balance with Venmo. Instead of waiting for a paper check, you can access your funds sooner with Direct Deposit, so you can pay Venmo friends or family, help out someone in your community, or shop at millions of online retailers that accept Venmo at checkout, or spend with your Venmo card everywhere Mastercard® is accepted.

Through Direct Deposit with Venmo, we’re not only making it easier to get paid right on time, but you may be able to access your paycheck up to two days early.*** While most traditional banks add a day or two for processing, we help get your money to you as soon as we receive notification from your employer, all without any extra fees.**** With faster access to your paycheck, you can do more with your money, sooner.

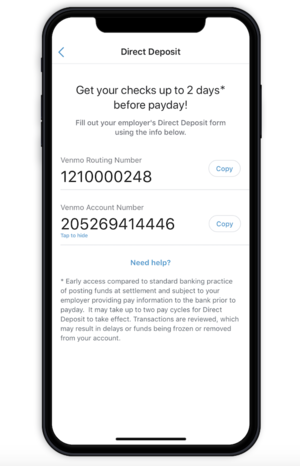

Setting up Direct Deposit is simple. To see if you’re eligible, select Settings from the drop down menu in the app and tap Direct Deposit, then fill out your employer’s Direct Deposit form using your Venmo-assigned Account and Routing Numbers, and we’ll do the rest.

Accessing Your Economic Impact Payment Digitally

In addition, the IRS launched a new tool for people around the country who would like to receive their Economic Impact Payment digitally, rather than via a paper check. This means select Venmo users can elect to send their stimulus payment directly to their balance with Venmo once they have Direct Deposit set up.

Once you have been enrolled into Direct Deposit, you can receive your stimulus payment into your balance by following these steps:

-

Log into your Venmo account in the app.

-

To view your account number and routing number, tap the ‘☰’ icon, and then click on Settings → Direct Deposit, then select ‘Show Account Number’ to see your Venmo assigned account number, as well as the routing number required for the IRS portal.

-

You can enter the account number and routing number listed in your Venmo Profile under Direct Deposit in the IRS tool to receive your payment.

*Direct Deposit information can only be changed using the IRS tool if you have not filed your 2019 or 2018 tax return, or if you filed your 2019 or 2018 tax return without providing Direct Deposit information.

**Limited to Direct Deposit of a federal or state tax refund, where permitted under applicable law. If you have questions about Direct Deposits from a federal agency, visit godirect.gov.

***Early access compared to standard banking practice of posting funds at settlement and subject to your employer providing pay information to the bank prior to payday. It may take up to two pay cycles for Direct Deposit to take effect. Transactions are reviewed, which may result in delays or funds being frozen or removed from your account.

****The availability of Direct Deposit is subject to your employer sending paycheck information 1-2 days in advance of payday. While Direct Deposit is available at no cost, certain other transaction fees and costs, terms, and conditions are associated with the use of the Venmo debit card. See the Cardholder Agreement and Venmo fees for more details.

The Venmo Mastercard® is issued by The Bancorp Bank pursuant to license by Mastercard International Incorporated. The Bancorp Bank; Member FDIC. Card may be used everywhere Mastercard is accepted in the U.S. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. The Bancorp Bank does not endorse or sponsor, and is not affiliated in any way with this reward program.

Article last updated 08/12/2020