- In the coming weeks, Venmo will begin to roll out new payment types and expanded purchase protections that will enable customers to safely send and receive payments for goods or services.

- Payments tagged as for goods or services will be eligible for coverage under Venmo’s Purchase Protection Program, meaning the buyer and seller may be covered if the transaction doesn’t go as expected.

- Goods and services transactions are ideal for customers who may occasionally sell an item or service or for customers purchasing a higher priced item from someone they don’t know.

As Venmo’s platform continues to grow and evolve, we’ve introduced a number of ways for customers to pay with Venmo - from shopping online and in-store at retailers that accept Venmo at checkout, and even in their local community at more than half a million business profiles on the Venmo platform across the U.S.

As we’ve introduced these new experiences, we’ve also seen increasing consumer demand in the market for a safe and easy solution that enables people to buy and sell other items or experiences that may fall outside of a traditional business setting. Often times, these transactions take place between people that may extend beyond someone’s friend group or network. In a 2020 survey of our userbase1, more than half of Venmo customers surveyed shared that if available, they would be most likely to make a purchase from someone they don’t know if their transaction provided purchase protection, providing them peace of mind knowing that they’re covered if their purchase doesn’t go as expected.

To make it even more seamless for customers to complete these types of transactions, we’re excited to introduce new payment types and expanded purchase protections that will enable customers to safely send and receive payments for goods or services, empowering the Venmo community to buy and sell with confidence in new and exciting ways.

How it Works

Beginning to roll out in the coming weeks, Venmo customers will have expanded options to choose from when sending money to other users, enabling them to send and receive payments for goods or services - for use cases like selling concert tickets to a friend of a friend or purchasing a couch from a local ad listing. Payments tagged as for goods or services will be eligible for coverage under Venmo’s Purchase Protection Program, just like Venmo Debit Card purchases, pay with Venmo purchases, and business profile payments. Goods and services payments are designed to provide both buyers and sellers peace of mind knowing that they may be covered if the transaction doesn’t go as expected.

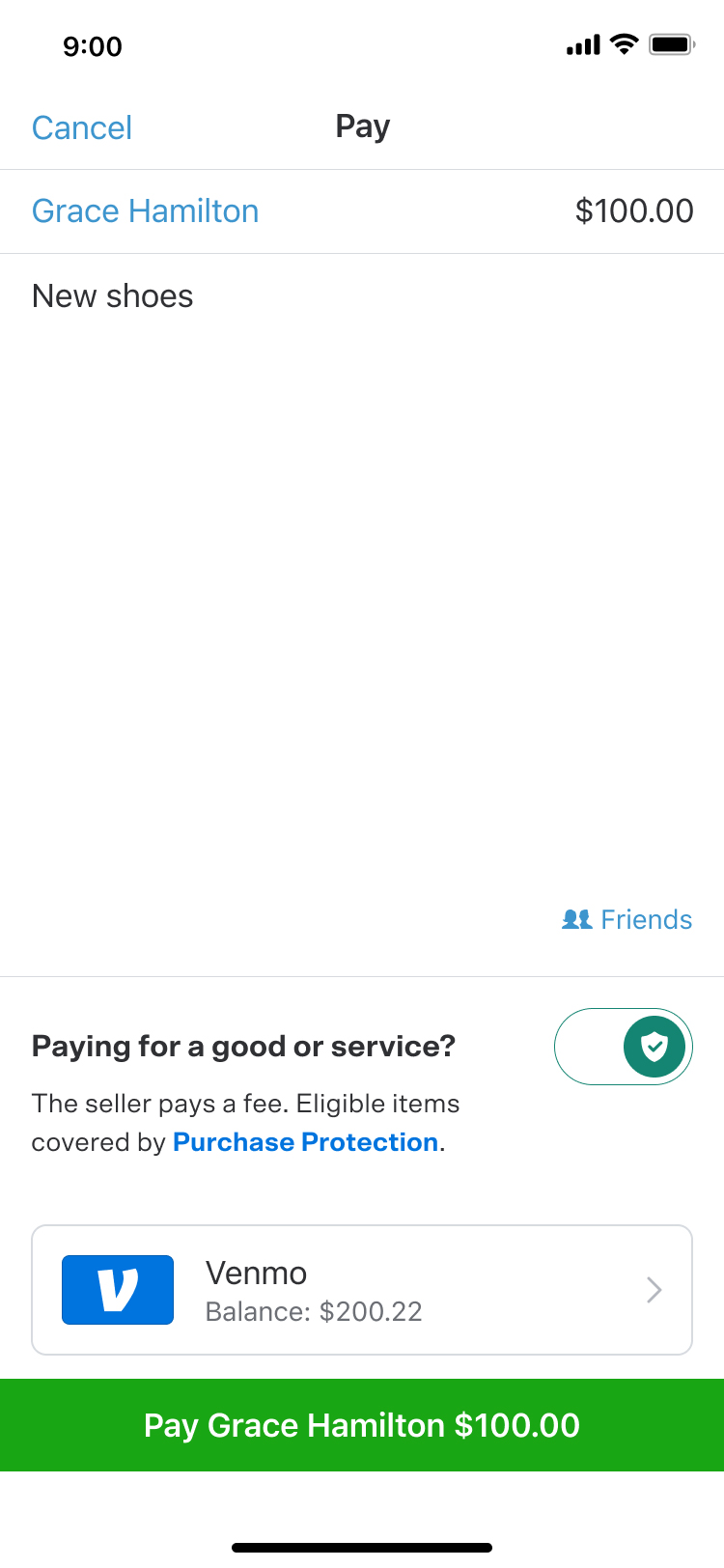

To send a goods or services payment, customers can simply toggle the button on the payment note screen to identify the payment as for a good or service. The seller will pay a small fee to receive their money (1.9% of the transaction+ .10 cents) which is automatically deducted from the total amount sent, and the transaction will be eligible for coverage under Venmo’s Purchase Protection Program, meaning that both customers may be covered if something goes wrong. For full terms, see the Venmo User Agreement.

These types of transactions are ideal for customers who may occasionally sell an item or a service, or for customers looking to purchase a higher priced item from someone they don’t know, giving customers added trust and confidence that Venmo has them covered.

Two-Sided Protection

When a buyer sends a payment for a good or service, they may be able to have their money refunded on eligible purchases if things don’t go as expected, for example, if they don’t receive the item or it looks significantly different than what was described by the seller.

Similarly, beginning July 20, 2021, when a seller receives a payment identified as for goods or services or to their business profile, they may also be eligible to keep the full amount from the sale, for example, if the buyer claims that they did not authorize the payment or that they did not receive the item from the seller, if the seller can provide proof that they shipped the item or fulfilled the transaction.

These new updates will be rolling out in the Venmo app in the coming weeks. Be sure to download the latest version of the Venmo app on iOS or Android to access these new experiences!

The Venmo Mastercard® is issued by The Bancorp Bank pursuant to license by Mastercard International Incorporated. The Bancorp Bank; Member FDIC. Card may be used everywhere Mastercard is accepted in the U.S. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. The Bancorp Bank does not endorse or sponsor, and is not affiliated in any way with this reward program.

1 Based on a July 2020 survey commissioned by Venmo, conducted with 2000 of its customers.