PerformanceInnovationResearch and Insights

Global Public Policy and Research Team

The Third Wave of FinTech Innovation is a four-part essay series that explores emerging and evolving trends in FinTech. The research study draws upon data collected from a global survey of 4,000 individuals across four markets – the U.S., China, Brazil, and Germany.

Essay #1 | Essay #2 | Essay #3 | Essay #4

Essay #1

Introduction

Even before the COVID-19 pandemic and the acceleration of all things digital, several analysts were proclaiming that we were at the advent of a third wave of innovation in financial technology.1 In discussing past and present waves, there has been no lack of historical analyses and future predictions, citing the catalytic impact of the global adoption of the Internet and mobile phones, or the rise of quantum computing, blockchain and related technologies.

Technological breakthroughs, however, are not the sole driver of new methods of financial intermediation. It is worth noting that each wave of innovation has appeared to take place within a larger story of economic disruption, regulatory reform, and finally, the evolution of business models that are made possible by newly available technologies.

If we think back on the late 1990s, we can trace the outline of the first FinTech wave in the aftermath of the bursting of the dot-com bubble, the rise of the commercial Internet, the Clinton Administration’s approach to principles-based Internet regulation, and the creation of companies like PayPal, Xoom, and Xero. The second FinTech wave commenced in the wake of the global financial crisis in 2008, followed by a sweeping overhaul of the U.S. financial regulatory system, and rise of the mobile Internet, forging the growth of next generation start-ups like SoFi, Acorns, and Venmo.

In the present, the sheer magnitude and longevity of the COVID-19 pandemic, and the ensuing financial hardship faced by individuals and small businesses, have increased the role that central banks and governments play in crisis containment and economic recovery around the world.

The pandemic has also raised new questions about how financial services can best meet evolving demands that are not well served by traditional financial services. Financial access and inclusion, for un-banked and under-banked populations in particular, remains a challenge – a point underscored by difficulties with efficiently distributing economic relief to those most in need. Indeed, disparities in financial access have become only starker, and the need for equitable innovation more important.

Lockdowns, social distancing, and increased reliance on work-from-home have sped adoption of digital solutions, which have reached new heights as more activity shifted from the physical to the digital realm.

New capabilities and business models are resulting from a series of emerging technological innovations. Technological advances, including machine learning, blockchain and future quantum computing, are driving increased automation and new functionalities that will change the underpinnings and provision of financial services. If the prior pattern of crisis combined with changes in regulatory environment and new technological capabilities holds, we may indeed be at the inception of a third wave of FinTech innovation, and there will be major implications for consumers, businesses, and governments around the world.

Against this backdrop, the Public Policy and Research team at PayPal has begun an exploration of the potential for a third wave of FinTech innovation. To help ground our inquiry we commissioned a global survey of 4,000 individuals across four markets –the U.S., China, Brazil, and Germany. The survey seeks to better understand how consumers around the world are currently accessing financial services and whether conditions are in fact ripe for a third wave of FinTech innovation.

The goal is to better understand whether a new paradigm of FinTech development is in fact underway; the needs and expectations of consumers; how the evolution of technologies may improve financial access and financial health; and the conditions and requirements for responsible and equitable innovation. On this last point, we are particularly interested in whether current regulatory approaches and frameworks will remain fit-for-purpose as the speed, infrastructure, and providers of financial services face rapid change.

1 https://fortune.com/2019/11/13/FinTech-third-wave-automation-bank-trends/;

https://commercevc.medium.com/how-will-covid-19-affect-FinTech-introducing-the-three-waves-dcd8b4b815b0;

https://www.businessinsider.com/goldman-sachs-global-head-of-fintech-on-the-three-waves-of-fintech-development-2016-9;

https://a16z.com/2020/01/21/every-company-will-be-a-FinTech-company/

Back to Top

Essay #2

Cash Is Still King, but the Future Is Cashless

The underpinning of all financial services is money itself – it is a medium of exchange, a unit of account, and a store of value that facilitates economic life. The future of money, its form, and even its functionality, has tremendous implications for a potential third wave of FinTech innovation.

With the acceleration of digitization, including in online shopping and contactless payments, many expected the COVID-19 pandemic to end the dominance of cash. However, cash continues to be important and resilient. Respondents to PayPal’s global survey reported using physical cash or coin to pay for everyday items nearly 50% of the time. Notably, the Baby Boomer generation in the U.S. reported relatively lower usage of cash, when compared with Brazil, China, and Germany, where Baby Boomers reported higher levels of cash usage than the aggregate baseline.

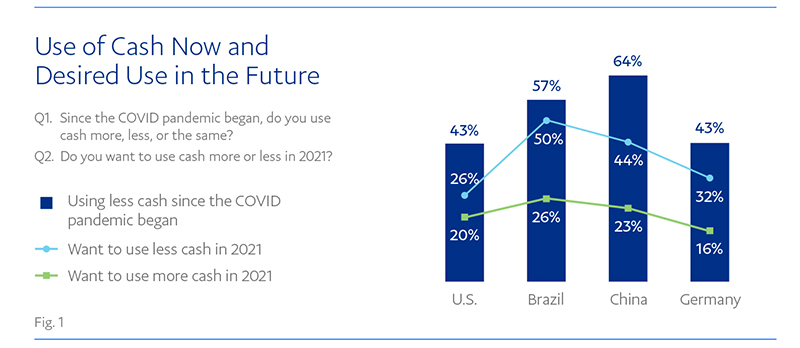

Our survey findings in aggregate indicate that the pandemic will decrease cash usage, but perhaps not as dramatically as some have predicted. Although a majority of respondents across all four markets are using less cash now due to COVID-19 and said they wanted to use less cash going forward, a solid minority indicated they wanted to use more cash in 2021 (Fig. 1). Some of this desire could be interpreted as pent-up enthusiasm for re-entering the physical world; it is still noteworthy that more than 1 in 5 people wanted to use more cash.

For in-person transactions, cash remains the preferred form of payment overall, although younger consumers report relatively higher usage of electronic payments. In aggregate, these findings indicate that even as trends in society point towards a reduction in the use of cash, there are reasons to believe that cash will remain popular for many consumers, at least in the near-to-medium term. The top reasons for using cash include the following: no fees, usability of cash anywhere, the ability to better control spending, and anonymity. These features of money are important to users and should provide important context when considering future forms of currency.

When it comes to digital payments adoption, the top reasons for usage cited by respondents include convenience, flexibility, and safety. These are distinct from the reasons for using cash, suggesting that cash and digital payments have different characteristics and offer different value propositions.

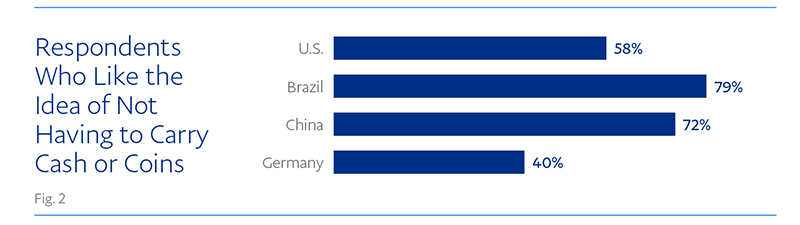

Looking towards the future, more than half of respondents expressed general excitement about the potential for a cashless future, with more than a third reporting high levels of excitement. Respondents in Brazil and China expressed higher overall degrees of enthusiasm for a cashless future than those in the U.S. and Germany. Seventy-nine percent of respondents in Brazil and 72% in China like the idea of not having to carry cash or coins, followed by 58% in the U.S. and 40% in Germany (Fig. 2).

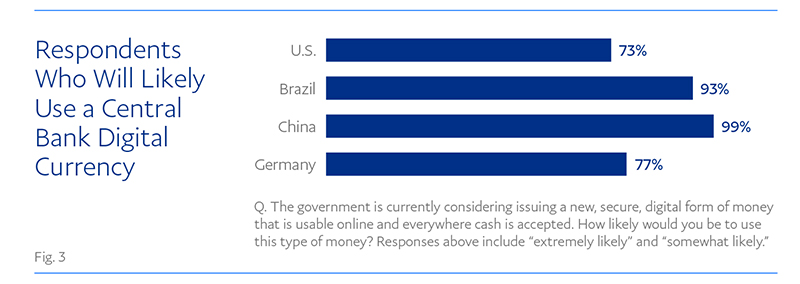

II. Beyond Cash

Survey respondents across all four markets expressed overwhelmingly high scores in being extremely or somewhat likely to use a central bank digital currency (CBDC), though totals were higher in China and Brazil as compared to the U.S. and Germany (Fig. 3). While younger consumers – especially Millennials – were the most likely to want to use CBDC, a substantial majority of heavy-cash users also indicated being somewhat or extremely likely to use CBDC. This latter point supports the potential for a cashless future and underscores the importance of bringing certain attributes to government-issued digital money, including “secure,” and “usable online and everywhere cash is accepted.”

Despite high scores for future CBDC use, respondents expressed mixed levels of enthusiasm for digital identity solutions as a replacement for physical identity cards, a development that would likely become a precondition for general usage of CBDC. Roughly 71% of respondents in the U.S. and Germany indicated a preference for carrying a physical driver’s license instead of a digital license on a smartphone, while 70% of consumers in China and 57% of consumers in Brazil expressed the opposite preference and favored a digital license. This finding may indicate greater readiness for digital solutions in China and Brazil, and underscores a tension with a cashless future in the U.S. and Germany, where comfort with digital payments may apply to the notion of CBDC but not necessarily to digital identity. Wide adoption of digital identity will likely require more education and marketing from both the public and private sectors in the U.S. and Germany.

What do these findings mean for consumers, industry, and policymakers?

Although the COVID-19 pandemic has generally accelerated the adoption of digital tools, including that of online and contactless in-person payments, and likely increased our collective readiness and demand for even greater digitization, consumer preference for cash remains high. In some markets such as the U.S. and Germany, a shift to digital payment options or even CBDC will require clear demonstration of safety and the benefits associated with cash: no fees, usability anywhere, the ability to better control spending, and strong privacy safeguards. But consumers in countries that aren’t as reliant on legacy systems – such as China and Brazil – are more ready to embrace and adopt digital innovations, including with respect to digital identity. Given the long history of legacy options, any education campaigns of CBDCs in the U.S. and Germany, especially for older generations, may benefit from the lessons of the introduction of Euros in 2002.

As for industry players, they have an opportunity to offer new models and digital solutions that meet the needs and preferences of consumers, in a way that articulates clear benefits relative to the status quo. They may also leverage new technologies, including tokenization, to retain attributes of physical cash that remain popular with consumers.

And finally, policymakers should be prepared for even greater and more rapid shifts to digital, including with respect to fiat currencies themselves. Policymakers might look to combine the benefits that consumers noted regarding both cash and digital payments in the form of a CBDC. Policymakers will also need to develop forward-leaning frameworks with respect to digital identity and ensure that consumer expectations regarding privacy and security are satisfied in the context of digital financial services, to promote trust, integrity, and confidence in new FinTech innovations.

Back to Top

Essay #3

To Bundle or Unbundle? That Is the Wrong Question.

“There are only two ways to make money in business: one is to bundle; the other is to unbundle.”1

- Jim Barksdale, former CEO of Netscape

Unbundling and bundling strategies have been pursued for as long as businesses have been around. With the arrival of the internet and mobile technologies came opportunities for disintermediating, specializing, and innovating existing business models. Examples of both bundling and unbundling strategies can be seen across industries. Music has been bundled into CDs, unbundled into individual MP3 tracks, and rebundled into subscription streaming services. The same can be said of newspapers, television, and software.

Similarly, banks have functioned as the “supermarket” for consumer financial services for decades,2 until the first wave of FinTech companies emerged with new approaches to solve for specific financial needs in the late 1990s and early 2000s – Digicash specialized in e-commerce payment solutions, and Xoom in digital cross-border remittances, for example. At the same time, companies like Yodlee and Envestnet, data aggregation and analytics platforms, saw the opportunity to help companies unbundle and port data from financial services providers to provide more tailored offerings. Banks were no longer the only option for payments, loans and credit, personal finance and investment management, savings, insurance, money transfer and others. The convenience of the one-stop-shop gave way to the novelty, sophistication, and specialization of multiple apps and channels.

After the global financial crisis in 2008-2009, the number of companies in traditional bank verticals continued to grow dramatically. The second wave of FinTech companies focused on launching singular product offerings and innovated to provide greater value and differentiate from what was available to consumers in the market. SoFi was founded as a student loan lender in 2011; Wealthfront started offering automated personal investment management the same year; and Venmo became synonymous with peer-to-peer transfers not long after its first transaction in 2009.

Nevertheless, bundling was taking place at the same time. Banks and FinTech startups alike added new product offerings to their own stacks. For example, Intuit incorporated Credit Karma and Mint to its suite of offerings, and Mint added new financial management features such as tax preparation and monitoring of unclaimed property databases to its initial budget planning offerings. Moreover, internationally, superapps such as WeChat and Alipay saw incredible success in bundling products as diverse as chat, shopping, delivery, and even marriage licenses!3

Will the third wave of FinTech innovation be defined by renewed bundling or further unbundling, or both?

The pandemic accelerated digitization of all things, including financial services. Some think (re) bundling and consolidation is inevitable in the wake of the COVID-19 pandemic, while some others argue that decentralized technologies like Bitcoin make unbundling the crux of the next generation of FinTech innovation. To understand if we are headed toward a bundled or unbundled future, PayPal’s Public Policy and Research team commissioned a global survey of 4,000 individuals across four major markets – the U.S., Brazil, China, and Germany. Survey data shows a lack of consensus and clarity around consumer preferences. In other words, the jury is still out.

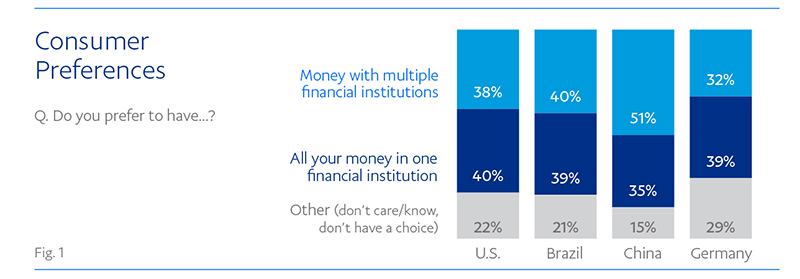

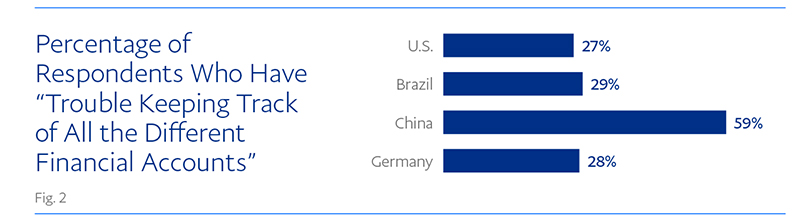

Consumers were asked about their behaviors and preferences regarding bundled financial services. Fig. 1 shows a similar percentage of individuals who prefer to have all their money in one financial institution (bundled) as the percentage of those who prefer to have their money with multiple financial institutions (unbundled) in the U.S., Brazil, and Germany. A higher percentage of respondents in China prefer having money in multiple financial institutions as opposed to having all their money in one financial institution. It is not surprising that a higher percentage of respondents in China indicated they have trouble keeping track of all the different financial accounts, compared to the U.S., Brazil, and Germany (Fig. 2).

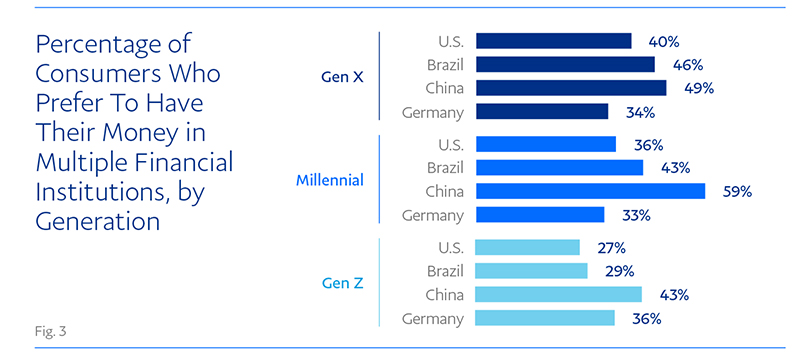

An analysis along generational lines reveals that in the U.S., Brazil, and China, a smaller percentage of Gen Z prefers having their money in multiple financial institutions compared to Millennials and Gen X (Fig. 3). This implies that as more of Gen Z enter a stage of financial maturity, they will potentially push the overall consumer preference towards bundled financial services. Of course, their preferences may evolve as their financial needs change.

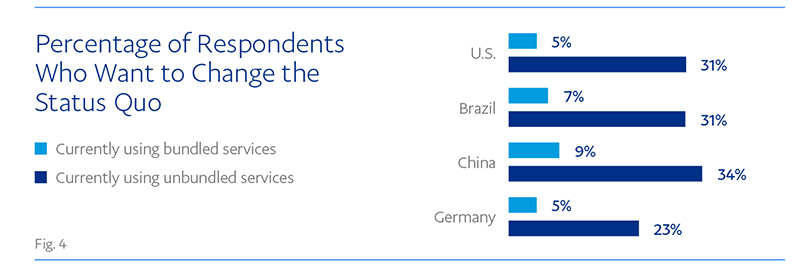

An analysis based on current behaviors suggests that the preference for bundling might be considerably “stickier” than the preference for unbundling across all markets. Respondents who have bundled financial services have very little desire to unbundle – less than 10% in every market we surveyed – while a significant portion of respondents – e.g. 31% in the US – who currently use unbundled financial services would prefer to bundle their financial services providers (Fig. 4).

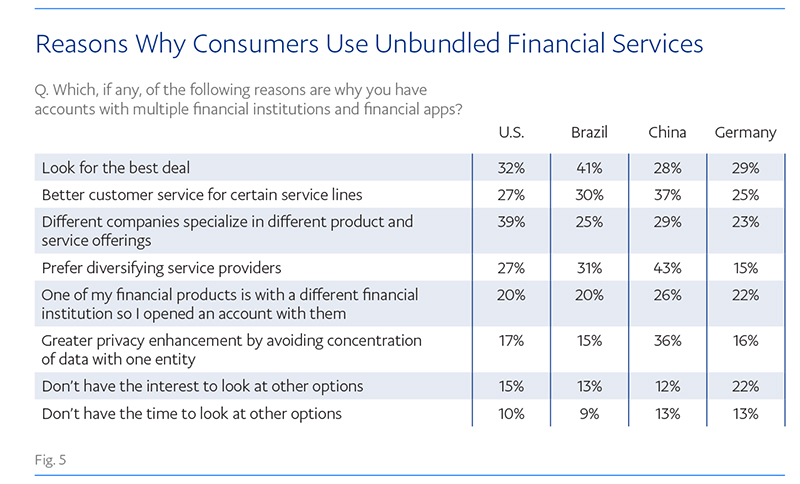

There are several reasons for relying on multiple financial institutions and financial apps (Fig. 5). First, many respondents – roughly 1 in 3 consumers across all four markets – believe that unbundled financial services allow them to capitalize on the “best deals,” and it is the most cited reason for using unbundled financial services in both Brazil and Germany. In other words, they appear to believe that bundling their financial services solutions into one provider might come at a higher cost or loss of benefits.

Second, respondents believe that “companies are specialized in different offerings.” This is especially true in the US, where 39% of consumers cited it as a reason for using unbundled financial services (Fig. 5). In other words, consumers will continue to manage multiple accounts rather than centralizing into one if they think unbundled offerings is how they utilize specialized solutions, and they might switch if they feel that bundled offerings give them access to equally sophisticated solutions that meet their needs. Other notable reasons include a general preference to “diversify service providers” and “better customer service for certain service lines.”

The reasons may potentially be correlated. Specialized offerings could mean more targeted and better customer service. Diversifying service providers may be driven by a desire to enhance privacy and avoid concentration of data with one entity. At least one fifth of respondents in all four markets stated “one of my financial products is with a different financial institution so I opened an account with them,” which suggests a direction towards bundling selectively, but it may also be explained by incentives and the search for the “best deal.” The difference between stated preferences and consumer behaviors is often complicated, but the gap lends support to the argument that the future is undecided.

Like the first and second wave of FinTech innovations, it is possible that the third wave will see trends towards both bundling and unbundling. It is unclear whether policy will steer or tilt the trends in a particular direction. Some public policy issues, including open banking and concerns about market concentration point to more competition and unbundling. But other policy choices, including narrow application of licensure and existing requirements, could reduce competition potentially driving bundling. Bundling and unbundling are both proven ways to succeed in markets; FinTech seems to be an example that proves the rule.

1 https://hbr.org/2014/06/how-to-succeed-in-business-by-bundling-and-unbundling

2 https://news.crunchbase.com/news/FinTech-startups-broke-apart-financial-services-now-the-sector-is-rebundling/

3 https://www.ft.com/content/0788d906-1a7b-11ea-97df-cc63de1d73f4;

https://www.chinadaily.com.cn/a/201908/07/WS5d4a7a80a310cf3e35564695.html

Back to Top

Essay #4

When Will Financial Services Go on Autopilot?

Advancements in big data and artificial intelligence have resulted in automation at scale across industries. Automation in financial services can be as mundane as “setting and forgetting” minimum or full credit card balance payments, and can be as futuristic as the name “robo-advising” suggests.

In the wake of accelerated digitization during the COVID-19 pandemic, we might expect much of our financial services activities to be taken care of by robots, but the full picture is more complicated. PayPal’s Public Policy and Research team commissioned a global survey of 4,000 individuals across four major markets – the U.S., Brazil, China, and Germany, to learn more.

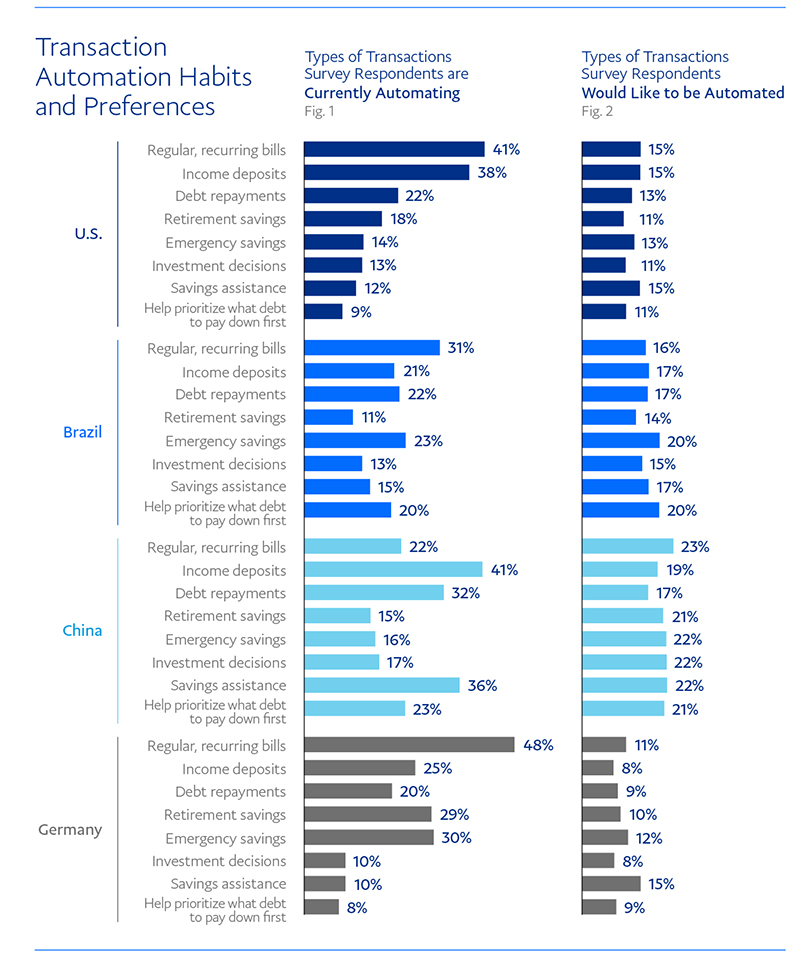

When asked which of their financial services activities are currently automated, survey respondents in the U.S., Brazil, China, and Germany all indicated low levels of automation (Fig. 1). For example, in most markets, only 1 in 5 consumers are automating debt repayments, with the highest rate in China (30%). Moreover, only 1 in 4 Germans have automated income deposits. Savings assistance, investment decision-making, and debt repayment advice log even lower levels of automation, averaging 17%. Only 15% of survey respondents in China, long regarded as a nation of savers, are currently automating retirement savings. The highest level of adoption pertains to bill payment in Germany, where close to 50% of consumers report using automation, whereas only 1 in 3 consumers in Brazil are doing the same.

The surprisingly low level of adoption of automated financial services is even more apparent when respondents were asked about their level of interest in the types of financial services they would like automated (Fig. 2). More openness was recorded in China and Brazil, where nearly 1 in 5 respondents expressed an interest in automating payment of regular recurring bills, income deposits, savings assistance, investment decisions, and debt repayments.; whereas over 40% of respondents in the U.S. and Germany would like “none of the above” automated.

While consumers may not enthusiastically opt in to automate financial services, many of them have in fact enjoyed the convenience of automation via embedded finance. Consider this scenario: In 2005, a passenger in a New York City taxi arrived at her destination and realized that she left her wallet at home; how could she pay for the ride? This hypothetical problem seems to have been eliminated by companies like Uber and Grab, due to the development of embedded finance, through which certain financial services — in this case, payments — are integrated within non- financial services activities. Where finance is embedded, consumers no longer need to spend time actively exploring and sourcing financial products. Instead, tailored financial offerings are available at the point of sale through the non-financial service platform. A great example of this can be seen with rapidly expanding Buy Now Pay Later (BNPL) solutions. Automation is key to reducing customer friction and remaining effectively “behind the scenes,” yielding a convenient and seamless experience for users. Some have even proclaimed that every company will be a FinTech company through embedded finance.1

The seeming contradiction between the hesitancy to automate found in our survey data and the anecdotal embrace of embedded finance may be revealing the central challenge of automation – choice as an optimal balance between convenience and control for consumers.

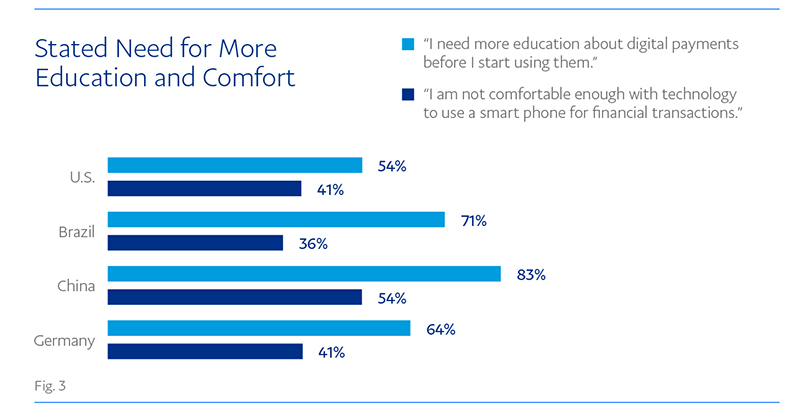

What might give consumers a sense of control? Respondents’ answer to another question might provide a clue (Fig. 3). Surprisingly, over 80% of respondents in China, arguably the most mature FinTech market, indicated they need more education about digital payments. Additionally, over 50% of respondents in China reported not feeling comfortable enough with the smartphone technology for financial transactions. Digitization has accelerated in unprecedented ways through the COVID-19 pandemic, but further user adoption of automation will only be achieved if consumers feel more comfortable with the technology and their perceived level of knowledge and understanding of how these services work, along with requisite safety tools.

With one in every five dollars invested by venture capital in 2021 having gone into FinTech,2 the third wave of FinTech innovation is poised to push forward, and there is a lot of room for automation to play a more prominent role in delivering quality financial services to consumers. If the trick is ensuring both convenience and control in consumer choice, then policymakers will need to consider appropriate safeguards over use of consumer data and application of software intended to automate decision-making. For their part, industry participants will need to conduct further research to understand how to structure and personalize the balance between convenience and control, perhaps even with a human touch.3

1 https://a16z.com/2020/01/21/every-company-will-be-a-FinTech-company/

2 https://www.economist.com/finance-and-economics/2021/07/15/investment-in-fintech-booms-as-upstarts-go-mainstream

3 https://www.forbes.com/sites/forbesbusinessdevelopmentcouncil/2021/06/29/financial-institutions-think-consumers-are-all-about-digital-but-customers-still-want-that-human-touch/?sh=1c7d88af762a

Back to Top