ProductResearch and Insights

by Thomas Lai, VP of Enterprise Sales, North America at PayPal

PayPal works with 8 of the top 10 food delivery merchants across North America and Europe1. On our Q4 2021 earnings call we shared that we recently expanded agreements with Instacart and DoorDash and welcomed Fareway Stores to the PayPal family.

The grocery and food delivery industries have undergone a series of challenges and hyper-growth in the last two years. Grocers faced hurdles related to inventory management, safe in-person experiences, and new digital checkout methods such as buy online and pick up in-store (BOPIS). Similarly, food delivery businesses had to manage high order volumes, lightspeed delivery demands, and providing access to consumers who were new to online shopping. Both industries served as essential businesses and critical players in ensuring food distribution and safe access during a time of great uncertainty.

While many were able to adapt in real-time, the X factor remains: customer loyalty. How do you create a loyal customer? What is the secret to habituation and stickiness? These are the questions we hear day in and day out from our merchant partners – in grocery, food delivery and beyond.

The Core Tenants of Customer Loyalty

Customer loyalty is built on three tenants: having the right combination of product offerings, economics, and service level. If a grocer can offer a customer all three of these things and create a one-stop shopping experience, that’s what drives stickiness.

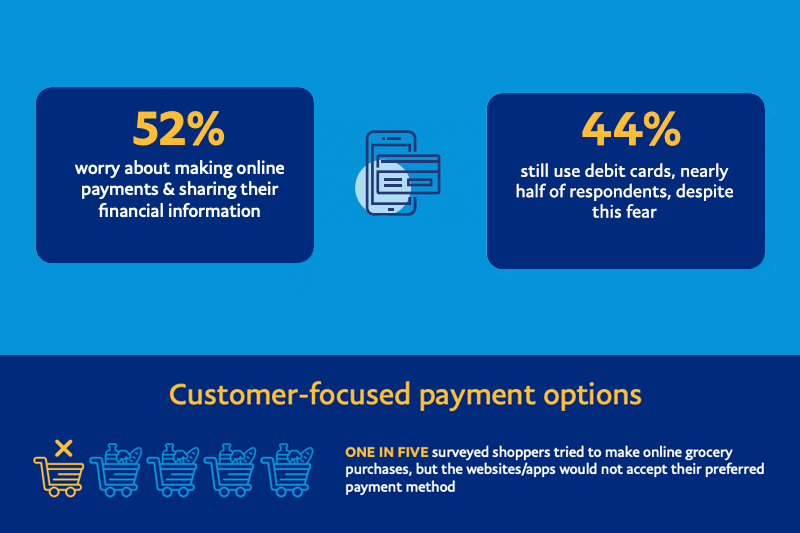

Product and technology variety

Product offerings relate not only to produce and pre-made meal selection, but also the technologies offered as part of the shopping experience. In a study done in collaboration with PayPal and the Maru Group on a grocery shopper's digital journey2, we found that one in five shoppers have tried to make online grocery purchases, but the website or apps would not accept their preferred payment types. The study also found that more than half (52%) still worry about making online payments and sharing their financial information. Despite this fear, nearly half of respondents (44%) still use debit cards and other payment methods.

Many people take for granted the level of acuity of their generation that makes managing everyday life much simpler. But for grocers, they need to look beyond just one demographic and think about users who have not bought digitally. For both digital and non-digital natives, choice in how they pay, simple payment methods and knowing their account information is secure are key in creating habituation and lifetime value.

This ease of use extends to the in-store experience. Technologies like QR Codes at checkout give customers a touch-free way to pay. They can also be used to encourage loyalty program sign-ups, helping grocers expand the breadth of what they do and get net new shoppers.

Albertson’s CEO, Vivek Sankaran, recently spoke with Sara Eisen, co-anchor of CNBC’s "Closing Bell" at NRF 2022: Retail's Big Show. He succinctly echoed these sentiments on stage when talking about customer loyalty as described in NRF’s recap, “We build a closeness at a very fundamental human level,” Sankaran said. “Then on top of that, you’re using a lot of technology — personalization, ecommerce, delivery — that builds on this emotional bond and creates a lot of stickiness. And I think that’s a lot of the value of the company.”3

The right price points

Our study also uncovered a growing population of more budget-conscious shoppers. 55% of respondents stated they often consolidate purchases into one large order to minimize spend on delivery fees. And 47% said they started using coupons and discount services a lot more. Making sure you have the right variety of products for consumers to buy only from you and find the best deals helps create loyalty.

The customer experience

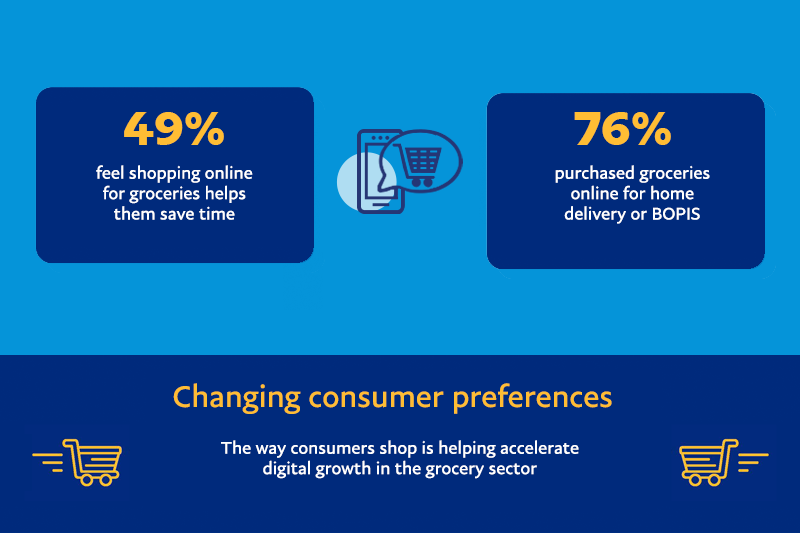

When it comes to service level, grocers have focused on removing the complexity of digital experiences to keep customers coming back. They’ve done this by making the experience easily repeatable and by decreasing cycle times for those who don’t have the time or are incapable of going to the store.

Our study found that 49% of survey respondents feel shopping online for groceries helps save them time and 76% have purchased groceries online for home delivery or BOPIS – another new time saving trick.

Digital groceries are here to stay

The shift to digital shopping is here to stay as 93% of those surveyed who use online payments said they will continue to do so in the future.

For grocers and food delivery services, the right selection of product offerings, attention to economics and a positive customer experience are what will determine who will win and lose.

1SensorTower of top apps by Monthly Active Users. Based on MAUs during 2H2021.

2Maru Group, commissioned by PayPal, October 28 - November 5, 2021. The study conducted by Maru Group via an online survey among 1,000 participants in the US., who were household decision makers who ordered their groceries online and/or ordered meal kits or food online from restaurants. Base: n=1,000. PayPal published infographic on Jan 21, 2022: https://www.paypal.com/us/brc/article/enterprise-solutions-online-grocery-infographic

3How Albertsons maintains close customer connections,” January 18, 2022, Peter Johnston, NRF Contributor: https://nrf.com/blog/how-albertsons-maintains-close-customer-connections