PayPalProductInnovationDigital Wallet

How to take advantage of PayPal’s new features to reach your financial goals.

From following a monthly budget, to managing financial accounts and credit card expenses, the financial goals of Gen Z and Millennial customers can add more stress than solutions. Nearly 72% of Gen Z and Millennial Americans find managing their finances stressful. And with so many products and apps, consumers are on the lookout for an uncomplicated way to manage their money. In fact, nearly half of consumers (48%) cite simplicity as the top reason they use a digital wallet1.

PayPal helps customers streamline and manage their financial lives, discover deals,

and make their money go further.

Last year, PayPal introduced a redesigned app experience with new features to better help customers streamline and manage their financial lives, discover deals, and make their money go further. PayPal makes it fast and seamless to manage cards, payments, transfers, and more – all in one convenient spot.

This year, we're continuing to expand these new features and enhancements to the app that will help customers make the most out of their money. Here are some tips to manage your money with PayPal:

PayPal Savings

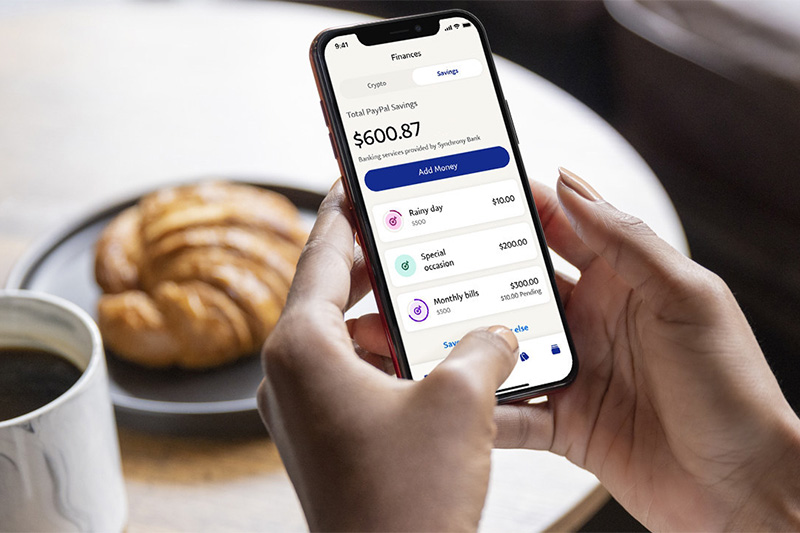

Only 52% of households in the U.S. have a savings account, with a median amount of savings held at $1,0102. PayPal Savings is a new savings account directly embedded in the app experience to give more U.S. customers the opportunity to build their wealth. PayPal Savings3, provided by Synchrony Bank, customers can turn their savings into something special while developing healthy savings habits in the process.

PayPal Savings benefits include:

- Watch your money grow: Set money aside and earn interest. The new savings solution enables access to a savings account with a competitive 0.85% Annual Percentage Yield (APY), which is 12 times the national average4.

- Added flexibility: No minimums, no fees. Customers can save with no monthly fees, no minimum deposit amounts, and no maximum withdrawals.

- Easy to manage: Use the PayPal app for 24/7 access to money transfers, goal tracking, and savings tips.

- Positive savings patterns: Customers can also set up automatic transfers to PayPal Savings to help them build regular habits and track toward their goals, like a rainy-day fund or dream vacation, without having to overthink it.

Direct Deposit

Customers can make their paydays come up to two days early when they set up Direct Deposit with PayPal. The Direct Deposit feature helps them get paychecks or government payments automatically sent to their PayPal balance without having to wait for a check in the mail or make a trip to the bank. From there, customers can use the money in their PayPal balance to shop, save or send money.

Bill Pay

To simplify payments on their monthly bills, customers can use the new PayPal app’s Bill Pay solution, which helps streamline payments on gas, power, and water bills and subscriptions.

With fewer steps to walk through, customers can choose their method of payment (i.e. credit or debit cards, bank accounts, or their PayPal balance) and track their bills from within the app or online with ease.

A PayPal Balance account is required for customers who want to manage their money, using PayPal Savings, Direct Deposit and Bill Pay.

Building for the Future

The PayPal app helps provide customers with an enhanced suite of tools that allow them to easily and securely spend, send, save and manage their transactions – all in one place. With each new habit created, customers can begin to build for the future without feeling they have to leave their financial goals behind.

Learn more about the PayPal app here.

1IDC White Paper, “Consumer Bill Payment Behaviors and Preferences Trending Toward Digital Wallets”, sponsored by PayPal, March 2021. IDC partnered with PayPal to study how ecommerce-enabled enterprises in US are adapting to today’s digital economy and which business-level objectives are driving technology investments.

2Consumer Federation of America Report August 2021

3PayPal is a financial technology company, not a bank. Banking services provided by Synchrony Bank, Member FDIC.

4As of May 24, 2022, the annual percentage yield (APY) for PayPal Savings is 0.85%. This is a variable rate and can change at any time, including after the account is opened. National average source: FDIC National Rates and Rate Caps as of May 16, 2022.