PayPal Introduces Customers to the Next Digital Payments Era with the New PayPal App

PayPal introduces new features and services, adding access to high yield savings, in-app shopping tools, deals and rewards, up to two-day early access Direct Deposit, and bill pay

All-in-one, personalized app provides PayPal customers with a single destination to easily and securely manage their daily financial lives and do more with their money

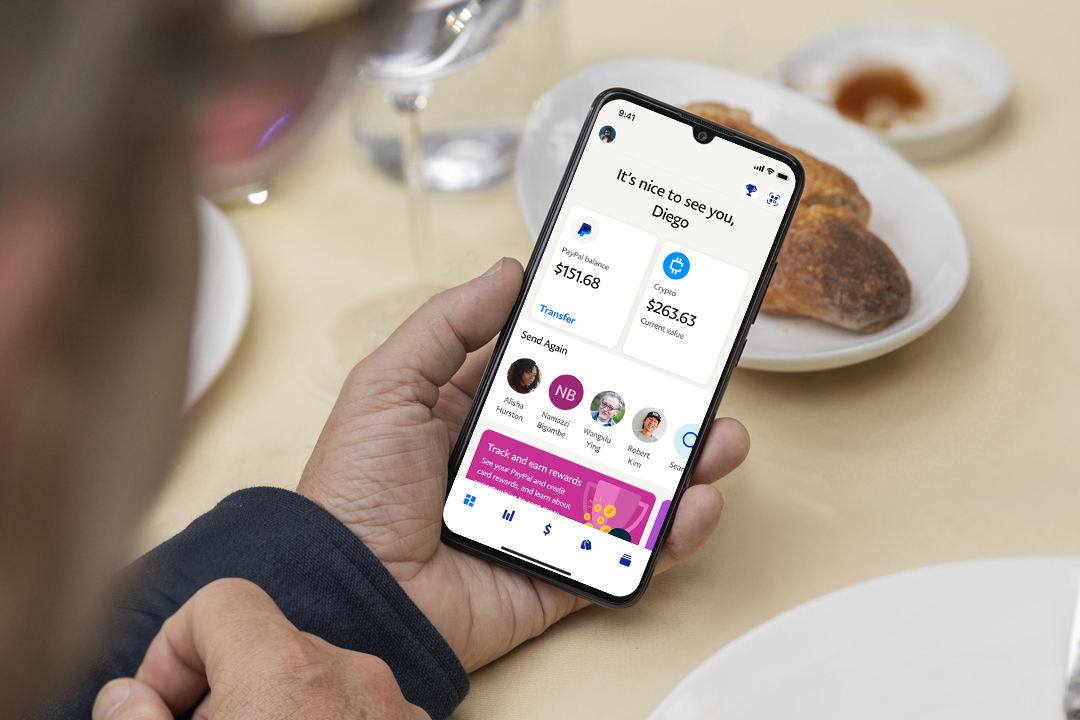

SAN JOSE, Calif., Sept. 21, 2021 /PRNewswire/ -- Today, PayPal announced the new PayPal app, an all-in-one, personalized app that offers customers the best place to manage their financial lives. The new PayPal app will introduce new features including PayPal Savings, a new high yield savings account provided by Synchrony Bank, alongside new in-app shopping tools that will enable customers to earn rewards redeemable for cash back or PayPal shopping credit and uncover deals with hundreds of merchants.

Additionally, the new app offers PayPal customers a single place to manage their bill payments, get paid up to two days earlier with the new Direct Deposit feature provided through one of our bank partners, earn rewards and manage gift cards, send and receive money to friends, family and businesses, pay with QR codes for purchases and redeem rewards in-store, access and manage credit, Buy Now, Pay Later services, buy, hold and sell crypto, as well as support causes and charities they care about.

The new app includes a personalized dashboard of a customer's PayPal account, a wallet tab to manage payment instruments and Direct Deposit, a finance tab that includes access to high yield savings and crypto capabilities, and a payments hub that includes send and receive money features, international remittances, charitable and non-profit giving, bill pay, and a two-way messaging feature to send notes of acknowledgment after peer-to-peer transactions.

The number of consumers using digital wallets is expected to double to 4.4 billion globally by 20251, and nearly half of consumers (48%) already cite simplicity as the top reason to use a digital wallet2. The new PayPal app aims to address this by offering an all-in-one app as the primary destination for customers to easily manage their day-to-day financial lives.

"We're excited to introduce the first version of the new PayPal app, a one-stop destination for our customers to take charge of their everyday financial lives, with new features like access to high yield savings, in-app shopping tools for customers to find deals and earn cash back rewards, early access Direct Deposit, and bill pay," said Dan Schulman, president and CEO of PayPal. "Our new app offers customers a simplified, secure and personalized experience that builds on our platform of trust and security and removes the complexity of having to manage multiple financial or shopping apps, remember different passwords and track loyalty rewards."

In the coming quarters, PayPal plans to add new features and enhancements to the app, including investment capabilities and more ways to pay with the app online and in-store, including the ability to pay with QR codes in an offline environment and enhanced PayPal-branded capabilities that offer new ways to shop and save in-store.

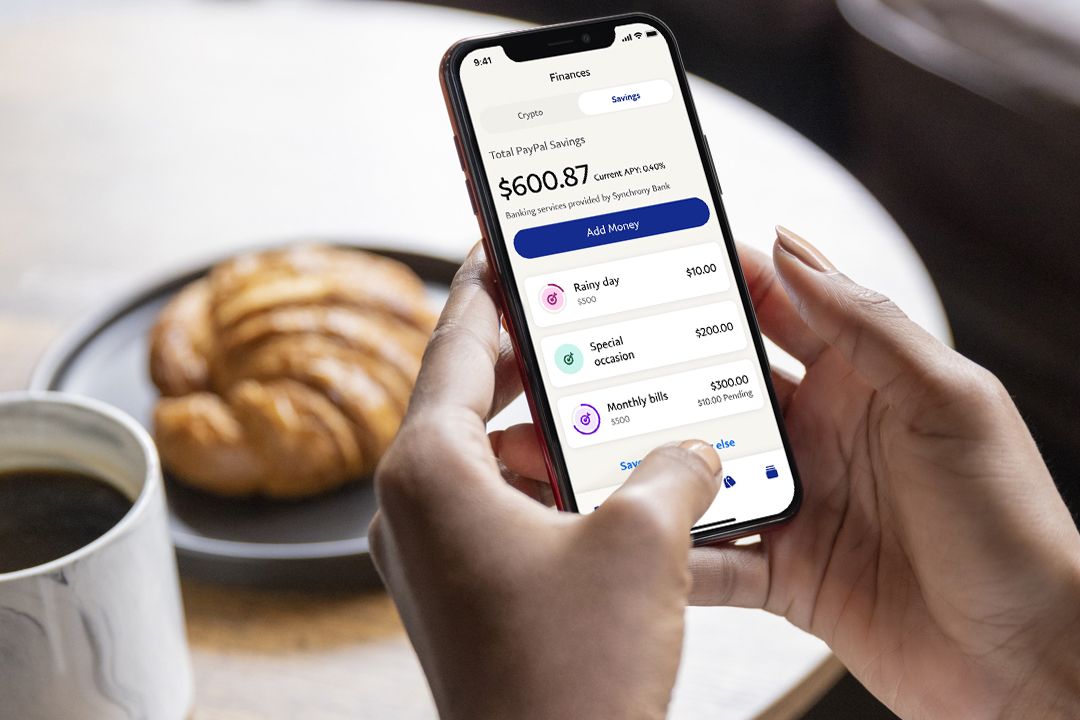

Save and Earn More with PayPal Savings

PayPal Savings is provided by Synchrony Bank and offers customers a way to access a competitive high yield interest rate and can help encourage the development of healthy savings habits. With the average national savings account only offering customers an interest rate of 0.06%3, PayPal Savings enables access to a savings account with a competitive 0.40% Annual Percentage Yield (APY)4, that is more than six times the national average, with no minimum balance or monthly fees. Customers can also create savings goals with visuals of what they want to achieve and track their progress, while automatic transfers to PayPal Savings can help create regular habits and achieve financial goals.

Customers can easily transfer money between PayPal Savings and their PayPal balance to use on purchases with PayPal. Interest amounts are provided to the customer at the end of their statement period on a monthly basis. PayPal Savings is planned to start rolling out to customers in the U.S in the coming months.

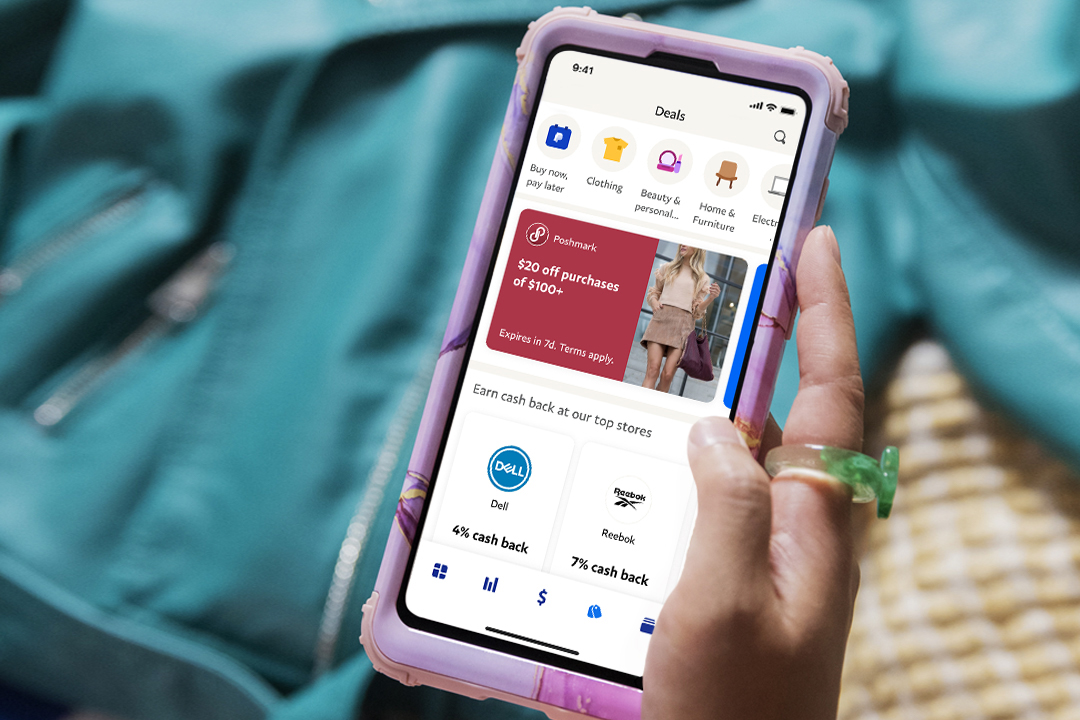

New Shopping Tools, Exclusive Deals and Cash Back Rewards

The new PayPal app will introduce a range of new shopping tools to enable customers to discover exclusive deals, make purchases and earn rewards seamlessly within the app. Shoppers will be presented with discounts and offers on hundreds of popular brands and will be able to shop through the in-app browser. Customers will be able to save deals to their wallet for future use when they checkout with PayPal in the app or online and use the in-app browser to search for coupons for even more ways to save when shopping with PayPal. The app will also include a new loyalty program, where customers can earn rewards redeemable for cash back and PayPal shopping credit on eligible purchases completed with PayPal.

Better Ways to Manage Your Money

The new PayPal app enhances existing features, including the ability to get paid up to two days earlier with Direct Deposit. With early access Direct Deposit, provided through one of our bank partners, customers can add all or a portion of their paycheck and other payments to their PayPal Balance account electronically.

Additionally, enhanced Bill Pay functionality offers customers a way to track, view and pay their bills from thousands of companies including utilities, TV & internet, insurance, credit cards, phone and more, directly within the app. The Bill Pay feature will let customers set reminders for upcoming payments, schedule automatic payments, search and add favorite billers, and pay using any eligible funding source linked to their PayPal account.

The new PayPal app is an intelligent digital wallet powered by PayPal's artificial intelligence and machine learning to create a unique wallet experience that is enhanced and tailored for each customer.

The new PayPal app is starting to roll out today, and PayPal Savings and new shopping tools and rewards are planned to start rolling out to customers in the U.S. in the coming months.

About PayPal

PayPal has remained at the forefront of the digital payment revolution for more than 20 years. By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering more than 400 million consumers and merchants in more than 200 markets to join and thrive in the global economy. For more information, visit paypal.com.

Media Contacts:

Tom Hunter

thhunter@paypal.com

Juliet Niczewicz

jniczewicz@paypal.com

1Source: Juniper Research, Digital Wallets: key opportunities, vendor analysis and market forecasts 2021-2025

2Source: IDC, Thought Leadership White Paper, Commissioned by PayPal. June 2021. IDC partnered with PayPal to study how ecommerce-enabled enterprises in US are adapting to today's digital economy and which business-level objectives are driving technology investments.

3Source: FDIC National Rates and Rate Caps as of August 16, 2021.

4 As of the date of this release, we anticipate PayPal Savings will offer 0.40% APY at launch. This rate may change prior to launch and after an account is opened.

Banking services provided by Synchrony Bank, Member FDIC. Funds in PayPal Savings are held by Synchrony Bank and are eligible for FDIC deposit insurance up to $250,000, as applied to the aggregate funds in PayPal Savings and other funds held in Synchrony Bank in the same capacity.

Forward Looking Statements About PayPal

This announcement contains "forward-looking" statements within the meaning of applicable securities laws. Forward-looking statements and information relate to future events and future performance and reflect, among other things, PayPal's plans with respect to the new PayPal app and its features, functionality, availability, timing and expected benefits. Forward looking statements may be identified by words such as "seek", "believe", "plan", "estimate", "anticipate", "expect", "project", "forecast", or intend", and statements that an event or result "may", "will", "should", "could", or "might" occur or be achieved and any other similar expressions.

Forward-looking statements involve risks and uncertainties which may cause actual results to differ materially from the statements made. More information about these and other factors can be found in PayPal Holdings, Inc.'s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission (the "SEC"), and its future filings with the SEC.

The forward-looking statements contained in this announcement speak only as of the date hereof. PayPal expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in the expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

SOURCE PayPal Holdings, Inc.