Ivy K. Lau, Public Affairs and Strategic Research Lead Manager

Today is National Savings Day, an opportune moment for us to focus on ways to improve our resilience and financial health.

The ability to weather shocks and setbacks with short-term savings, instead of falling into debt, is one of the most foundational building blocks of financial health. The Federal Reserve found that in 2021, 68% of American households said their savings could cover a $400 emergency expense using cash or its equivalent, the highest level since the survey began in 2013. In other words, at our best, 32% of American households – that’s 106 million Americans – could not cover a $400 emergency expense using cash or its equivalent.

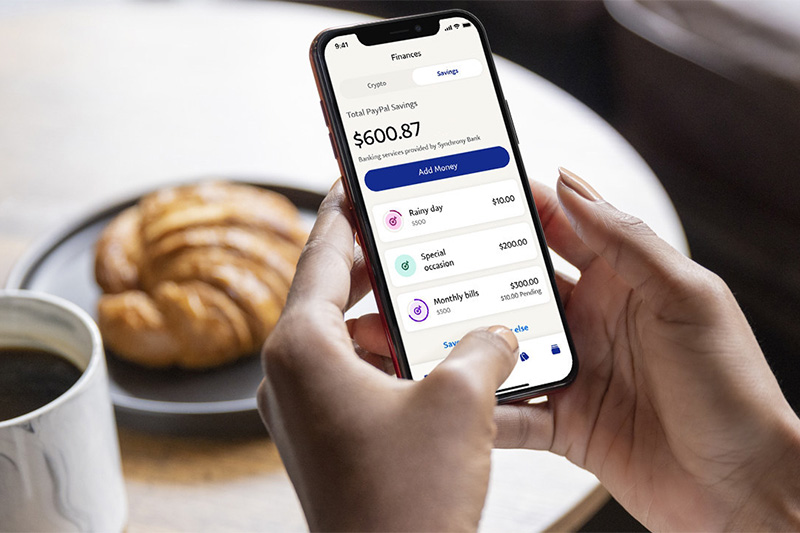

PayPal Savings offers a competitive APY rate with no minimum balance or monthly fees.

Long-term savings that can be used for vacations, the purchase of a home, and/or retirement are also key to financial health. Planning is critical for achieving our goals and dreams for the future. However, Vanguard found that the median 401(k) balance is $35,345 and on average, Americans have saved up $141,542 for retirement, which is equivalent to the median 2021 living wage for a single person in the U.S. for only 4 years.

In 2022, the personal saving rate in America has dropped as inflation and post-pandemic expenses take a bite out of savings. According to Bureau of Economic Analysis (BEA) data, the personal saving rate – personal saving as a percentage of disposable personal income – was 13.6% in October 2020 and has dropped to 3.5% in August 2022. Inflation, as indicated by the 12-month change in Consumer Price Index (CPI) for all items, reached 8.3% in August 2022, and threatens to further eat into saving rates.

While these metrics are cause for concern, they also function as a call to action. On this National Savings Day, we suggest that now is the time to save our dollars in safe places, where the money can go the most distance. Higher annual percentage yield (APY) in savings accounts means our savings balance will grow at a higher rate. PayPal Savings, provided by Synchrony Bank (Member FDIC),1 offers customers a competitive APY of 2.45%, which is 14 times the national average2 with no minimum balance or monthly fees. PayPal Savings customers can also create savings goals and track their progress, or set up automatic transfers to PayPal Savings which can help create regular habits and achieve financial goals. Find out more about PayPal Savings here.

Savings are critical for Americans across the socioeconomic spectrum. Of the 7.1 million Americans who are unbanked the most cited reason for not having a bank account was that they “Don’t have enough money to meet minimum balance requirements.” To help address this, financial services providers can offer quality savings products that do not require a minimum balance. Also, many fintech innovations, such as smart automated transfers and multiple saving goals, have been found to reduce friction and encourage savings.

Employers also have a role to play in increasing savings. Employers can make 401(k) schemes available, match employee contributions, and encourage adoption. Employers can also offer early wage access solutions that are bundled with budgeting and savings features. PayPal provides all its U.S. employees with free access to Even. The Even app provides the tools employees need to manage their money. Ten percent of PayPal employees who use Even put their wages into Even savings and this year, PayPal employees have saved over $225,000 by using Even towards their financial savings goals. With the ability to pause, decrease, increase, or transfer savings, Even provides flexibility in planning for the future and strengthens the financial wellness of employees.

1PayPal is a financial technology company, not a bank. Banking services provided by Synchrony Bank, Member FDIC. PayPal Balance account is required to use PayPal Savings.

2As of October 11, 2022, the annual percentage yield (APY) for PayPal Savings is 2.45%. This is a variable rate and can change at any time, including after the account is opened. National average source: FDIC National Rates and Rate Caps as of September 19, 2022.