By Ivy K. Lau, Public Affairs and Strategic Research Lead Manager

Report Index

- Introduction

- Market Size

- Interoperability

- Security

- Conclusion

- Download the Report (including Appendix)

Introduction

The term “metaverse” was coined by Neal Stephenson in his 1992 science fiction novel Snow Crash. In it he depicts a virtual reality-based successor to the Internet, where people use digital avatars of themselves to escape a dystopian reality in the online world. Three decades later, the metaverse is no longer only fictional.

About 25% of American adults under 40 own a virtual reality headset.1 In 2021, Bloomberg catalogued more than one thousand stories containing the term “metaverse,” while there had only been seven in all of 2010s.2 One of the most notable metaverse companies, Roblox, filed for its Initial Public Offering (IPO) in October 2020. As of February 2023, Roblox has a market cap of $26 billion and nearly 60 million daily active users. Facebook famously changed its name to Meta to reflect its strategic pivot and expansion into this space. Apple is set to release a mixed reality headset in June 2023.3 Statista projects the revenue in the metaverse market to reach 17.48 billion in 2023.4 McKinsey estimates that the metaverse could be worth $4-5 trillion by 2030.5

One of the most fundamental challenges in discussions about the metaverse is definitional. The term has evolved beyond Neal Stephenson’s vision in Snow Crash. The term “metaverse” is often used synonymously with “gaming,” “eSports,” “web3,” “Augmented Reality (AR)”, “Virtual Reality (VR),” “cryptocurrency,” “blockchain,” "non-fungible tokens" (“NFTs”) and other technological innovations. Much like the early days of the Internet, though, the exact shape and form of metaverse is still emerging and evolving. The metaverse does not refer to a single technology but it may be supported by a combination of all these innovations or permutations of a subset.

Gaming has certainly been critical in seeding the metaverse with platforms such as Decentraland, Fortnite , and Roblox, but the metaverse has other applications in verticals other than gaming, such as fitness, education, entertainment, and commerce. The metaverse will not necessarily replace current forms of fitness, education, entertainment, and commerce, and it will likely create new opportunities and enhance experiences in ways that are additive to what the Internet has enabled thus far. For example, cooking instructions with an AR enhancement could be more helpful and precise than recipes on a mobile app, but people may certainly continue to carry a smartphone and look up recipes on those devices in the future.

At the start of the pandemic, in April 2020, more than 12 million people who play the online game Fortnite logged in for Travis Scott’s 10-minute concert in the metaverse, where he performed on top of an eagle; arose from an explosion after an asteroid crashed; and, led concertgoers into the deep ocean and the outer space.6 However, the metaverse concerts didn’t replace or lessen the demand for in-person entertainment; more than 2 million tickets for Taylor Swift’s “Eras” tour were sold on a single day in November 2022. The virtual-reality successor to the current Internet may blur the line between the virtual and the physical world, but it will also enhance our experiences of both, without necessarily making one obsolete.

The working definition of the metaverse that we rely upon for this study is “a virtual space where users can act through an avatar and interact with each other and with a computer-generated environment.” The current state of the metaverse is primarily focused on gaming. The future of the metaverse will no doubt include additional categories – e.g., music, entertainment, games, and education – as technologies and business models evolve and mature.

This report is an attempt to understand how people spend, store, and engage with money in the metaverse, a topic that has yet to be extensively researched. The rise of the Internet, desktops, and mobile devices saw the creation of novel digital assets and payments solutions. If history is a guide, there is likely to be new financial services created and tailored for the needs of the metaverse.

This report is based on findings from a survey that was fielded by Logica Research and commissioned by PayPal in November and December of 2022. The sample included 10,000 adults who (a) currently use, used in the past, or are interested in (b) the metaverse, and/or cryptocurrencies and stablecoins, and/or VR and AR. In other words, the sample is best characterized as metaverse adopters and the metaverse-curious. A respondent is considered a metaverse user if they self-identified as such. The survey was conducted in 10 markets – United States, United Kingdom, Germany, Japan, Italy, Canada, Spain, South Korea, Australia, and Singapore. This essay focuses on the U.S. results.

By focusing on the people who are seeding the future of the metaverse, we hope to better understand consumer expectations on the metaverse and money in the metaverse.

Key Findings

The current focus of the metaverse is gaming, so it is not surprising that most of our survey respondents play games (95%) and identify as gamers (89%). Even before the advent of metaverse, mobile devices have already made gaming far more ubiquitous. In a 2022 survey of women in the U.S. and UK, nearly 75% of respondents said they play mobile games once per day, and more than 67% said mobile gaming is a key part of their downtime or “me time”.7 Interestingly, only half of respondents identified as metaverse users, which underscores that gaming and metaverse are not considered as synonymous to consumers.

Survey respondents who are metaverse users in the U.S. spend an average of 12 hours per week in the metaverse. Over four in five (83%) who are not current users say they are interested and expect to start using the metaverse in the next year.

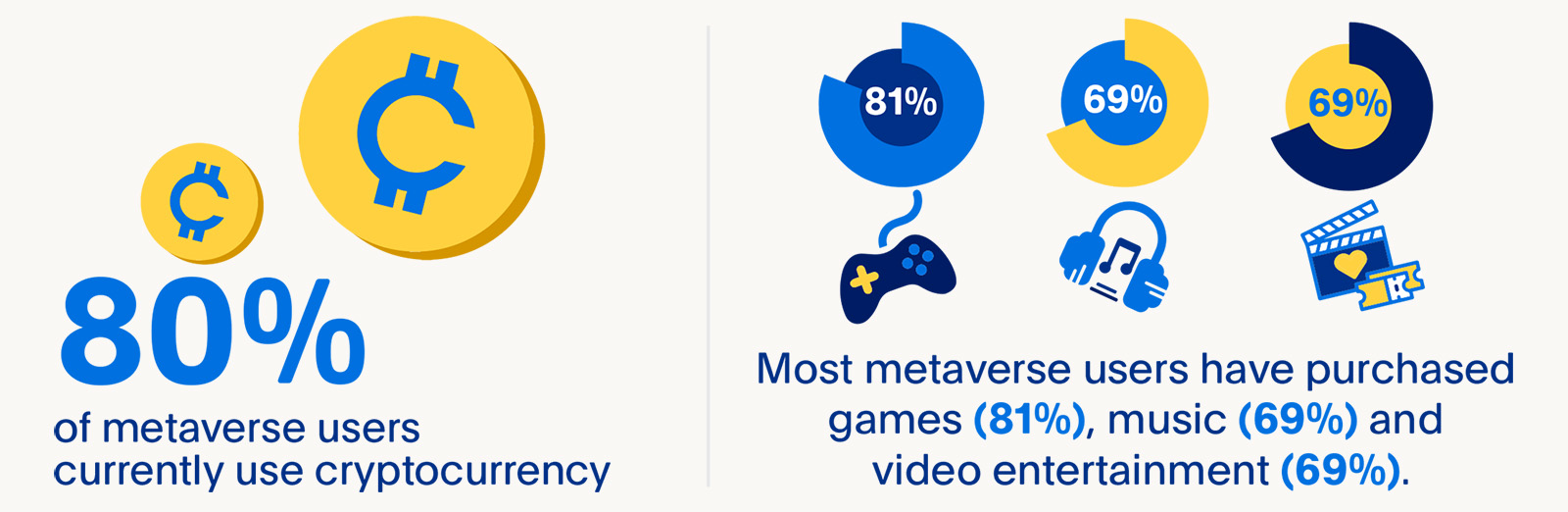

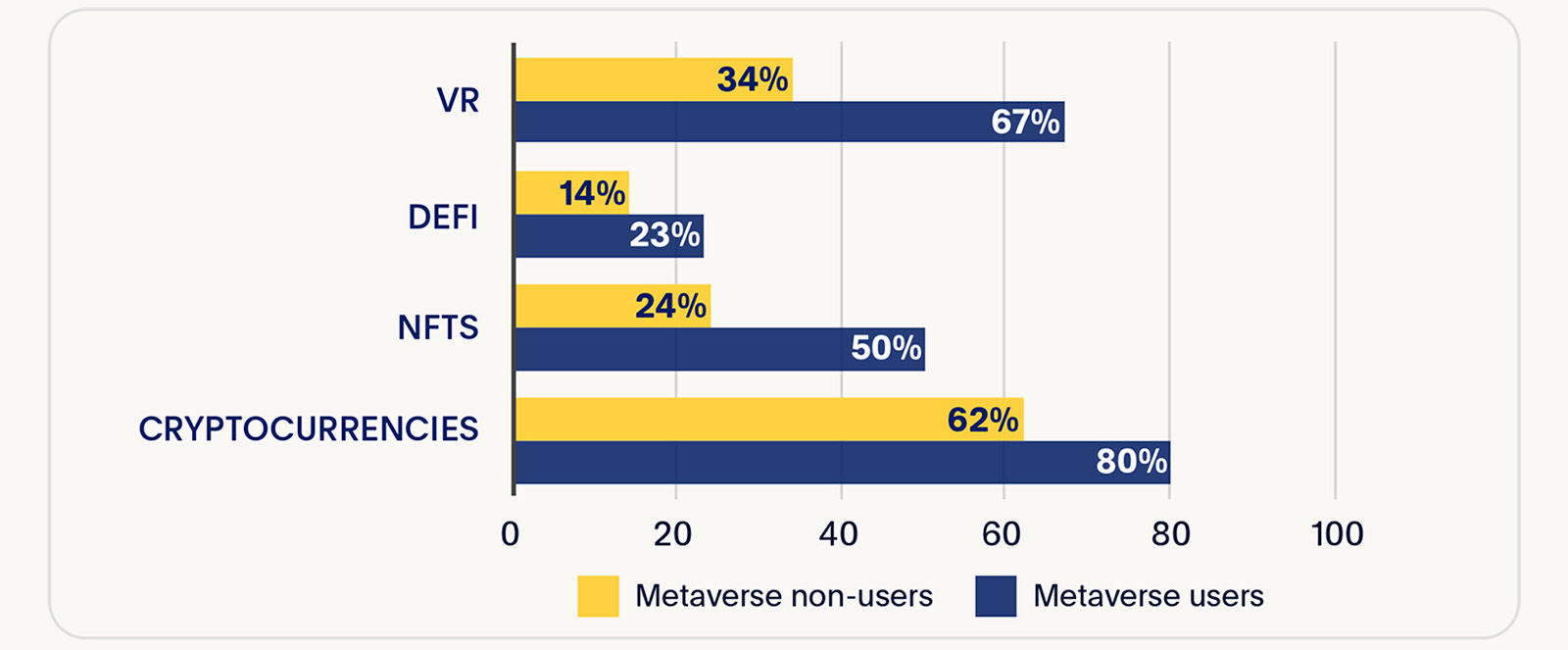

The usage of cryptocurrencies, NFTs, Decentralized Finance, and VR by both metaverse users and non-users is worth exploring (see Chart 1 below ). Generally, adoption of cryptocurrencies, NFTs, DeFi, and VR is higher among metaverse users relative to metaverse non-users . 80% of metaverse users and 62% of non-users currently use cryptocurrency. 50% of metaverse users and 24% of non-users own NFTs. 23% of metaverse users and 14% of non-users currently use decentralized finance (DeFi) products. Lastly, 67% of metaverse users and 34% of non-users currently use virtual reality.

Over 75% of survey respondents define the current metaverse as a virtual reality space (78%) that allows users to interact with each other (76%) and play games (73%). Looking forward, they see the metaverse as a place to meet new people (88%), socialize with friends and family (85%), play games (84%), shop for physical goods (82%) and shop for digital goods (84%).

When it comes to money in the metaverse, there were three overarching observations that apply across all 10 surveyed markets:

- There is a significant amount of money that is currently spent and held in the metaverse;

- There is a need for interoperability for money in the metaverse;

- There is a need for greater security around money in the metaverse.

Market Size

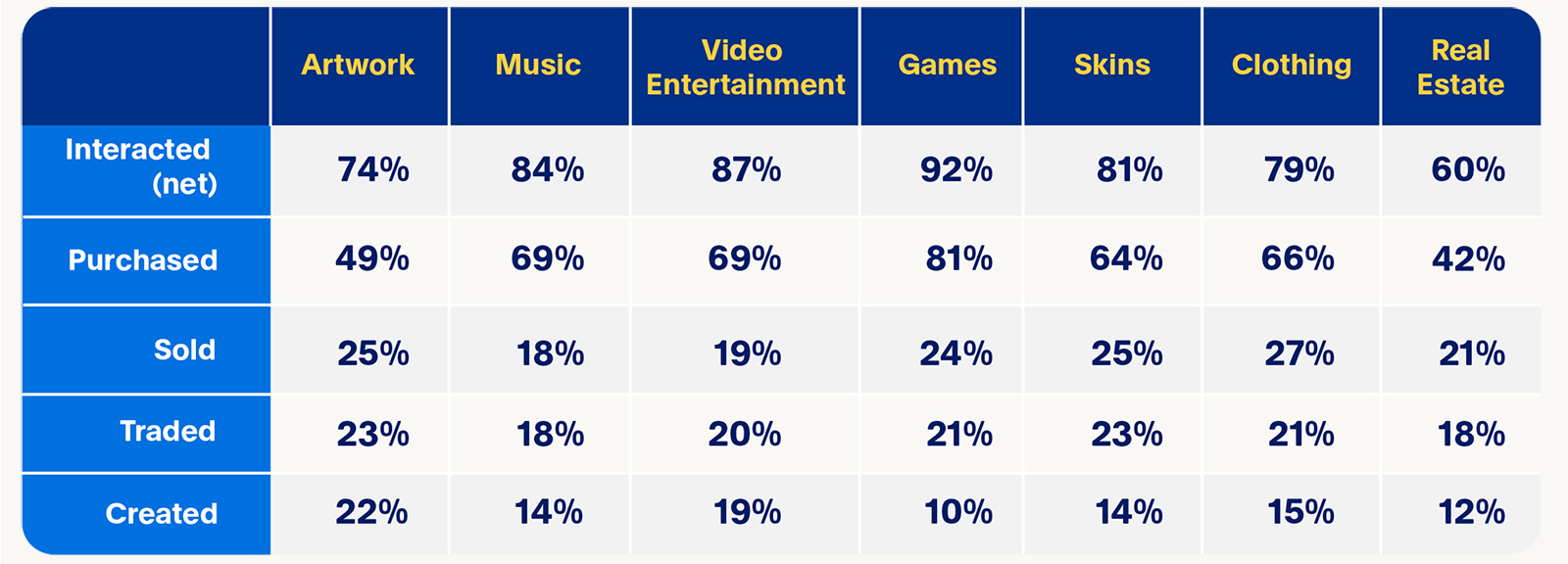

Given how much time people spend in the metaverse, it is not surprising that there is a large amount of money spent and held in the metaverse through the transactions of virtual goods (see Chart 2 below). Most metaverse users have purchased games (81%), music (69%) and video entertainment (69%). Almost half say they have purchased artwork. Two-thirds have purchased skins and clothing. In the 12 months prior to the survey, metaverse users have spent a median of $100 on goods such as skins and NFTs in the metaverse .

Chart 2. Interactions with Virtual Goods in the Metaverse by Users

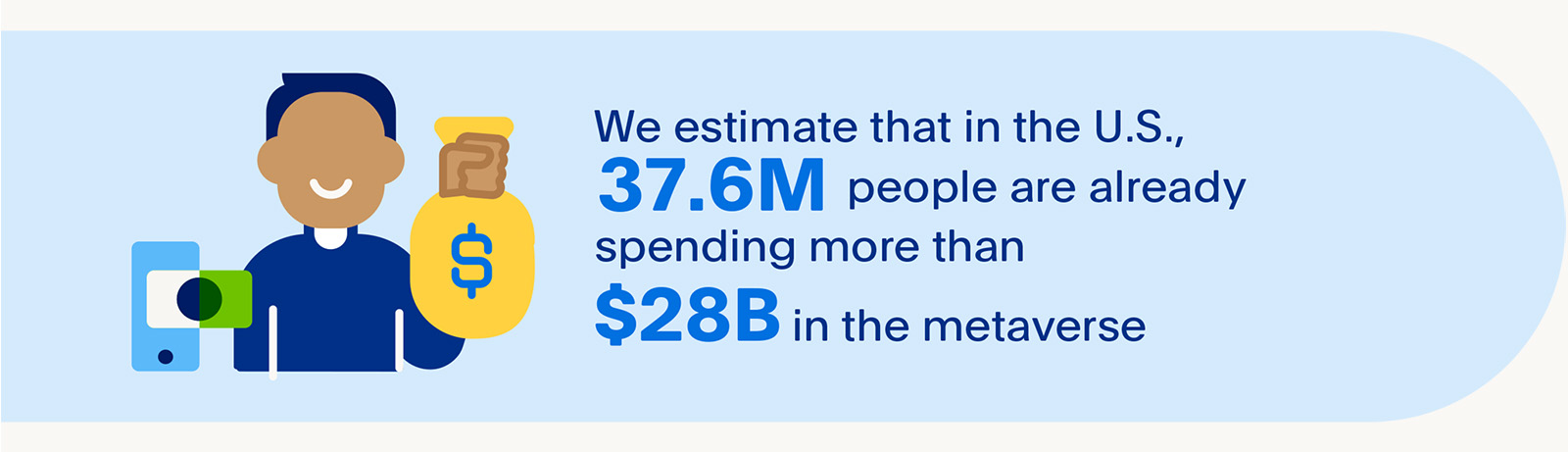

To estimate the overall market size of the metaverse in the U.S., we built a model utilizing three datasets: U.S. census data; previously published third-party surveys; and the survey we fielded.8 We estimate that in the U.S., 37.6 million people are already spending more than $28 billion a year in the metaverse. In terms of growth potential, there are close to 43 million metaverse-curious who expect to spend in the metaverse next year, and they expect to spend more than $37 billion a year. Moreover, the number of metaverse-curious who expect to spend money in the metaverse in the next 5 years is 45 million, and they expect to spend more than $38.8 billion over the next 5 years.

Taking current users and future users in the U.S. together, the estimated total spending in the metaverse would be $72.6 billion in the next year and $92.7 billion per year on average in the next 5 years.

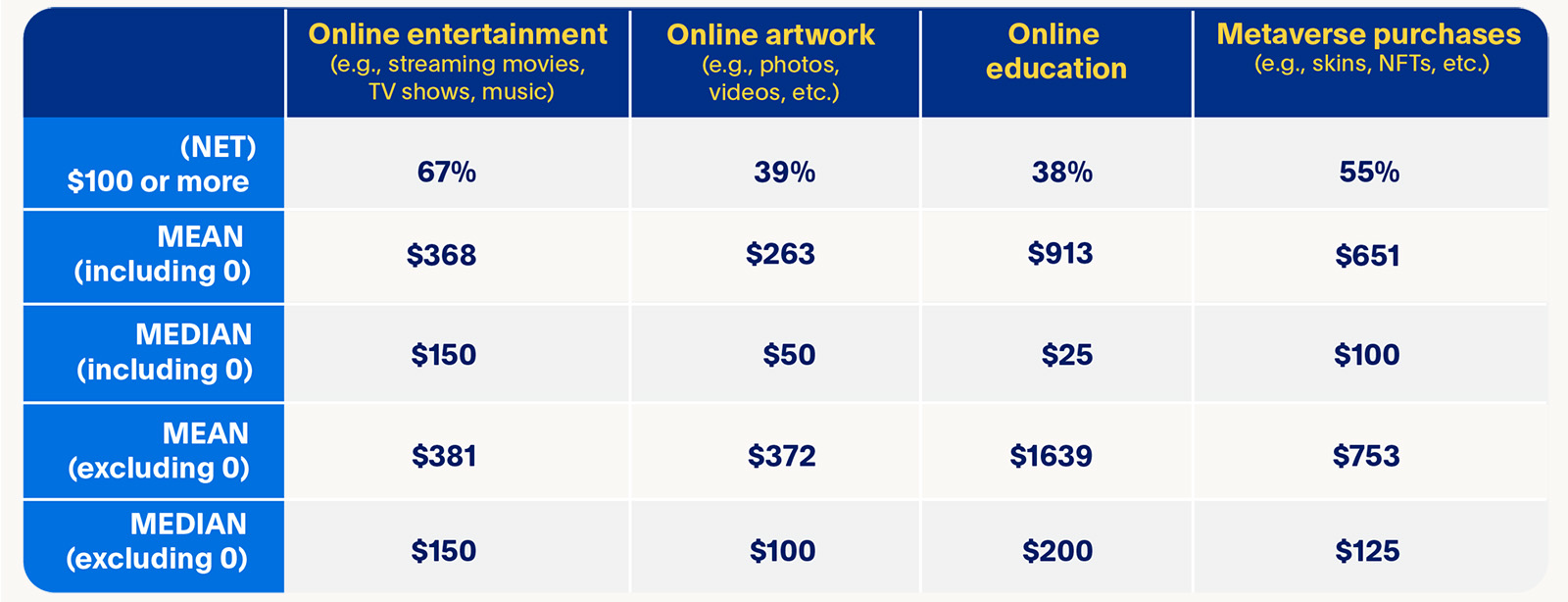

There are several digital goods categories that are expected to evolve and expand more fully as the metaverse grows (see Chart 3 below). Survey respondents spent an average of $368 on online entertainment, $263 on online artwork, $913 on online education, and $651 on metaverse purchases such as skins and NFTs in the 12 months prior to the survey. 67% of respondents have spent $100 or more on online entertainment. Nearly 40% of respondents have spent $100 or more on online artwork and online education. And 55% have spent $100 or more on metaverse purchases such as skins and NFTs. Our survey specifically excluded e-commerce in physical goods from the scope, and focused on purchases of digital goods (e.g., streaming TV show), a vertical that is most prime for metaverse applications (although 82% of survey respondents expect the metaverse to be a channel for the purchase of physical goods too, as described above).

Chart 3. Spending on Digital Goods in the 12 Months Prior to Survey

(Including Metaverse Users and Non-users)

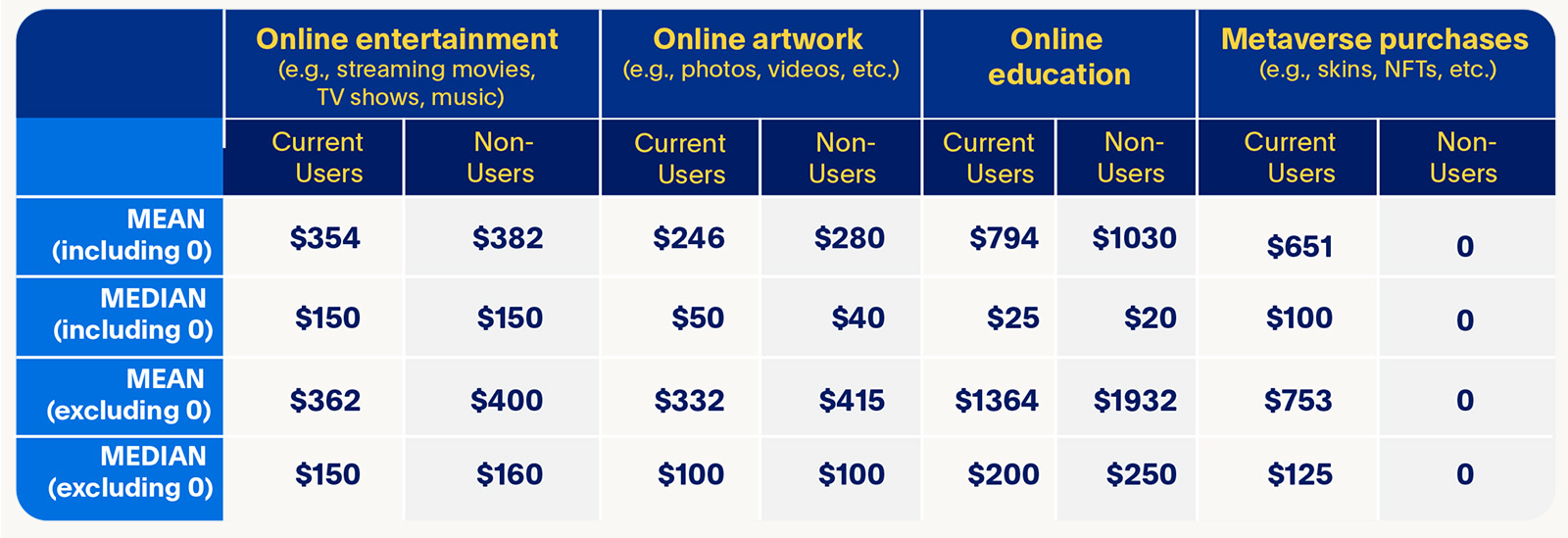

An analysis of spending by current metaverse users and non-users shows that both groups have made purchases in online entertainment, online artwork, and online education in the 12 months prior to the survey. In fact, people who are not current metaverse users have on the whole spent more than those who are (see Chart 4 below).

Chart 4. Spending on Digital Goods in the 12 Months Prior to Survey,

by Respondents who Identify as Metaverse Users vs. Non-users.

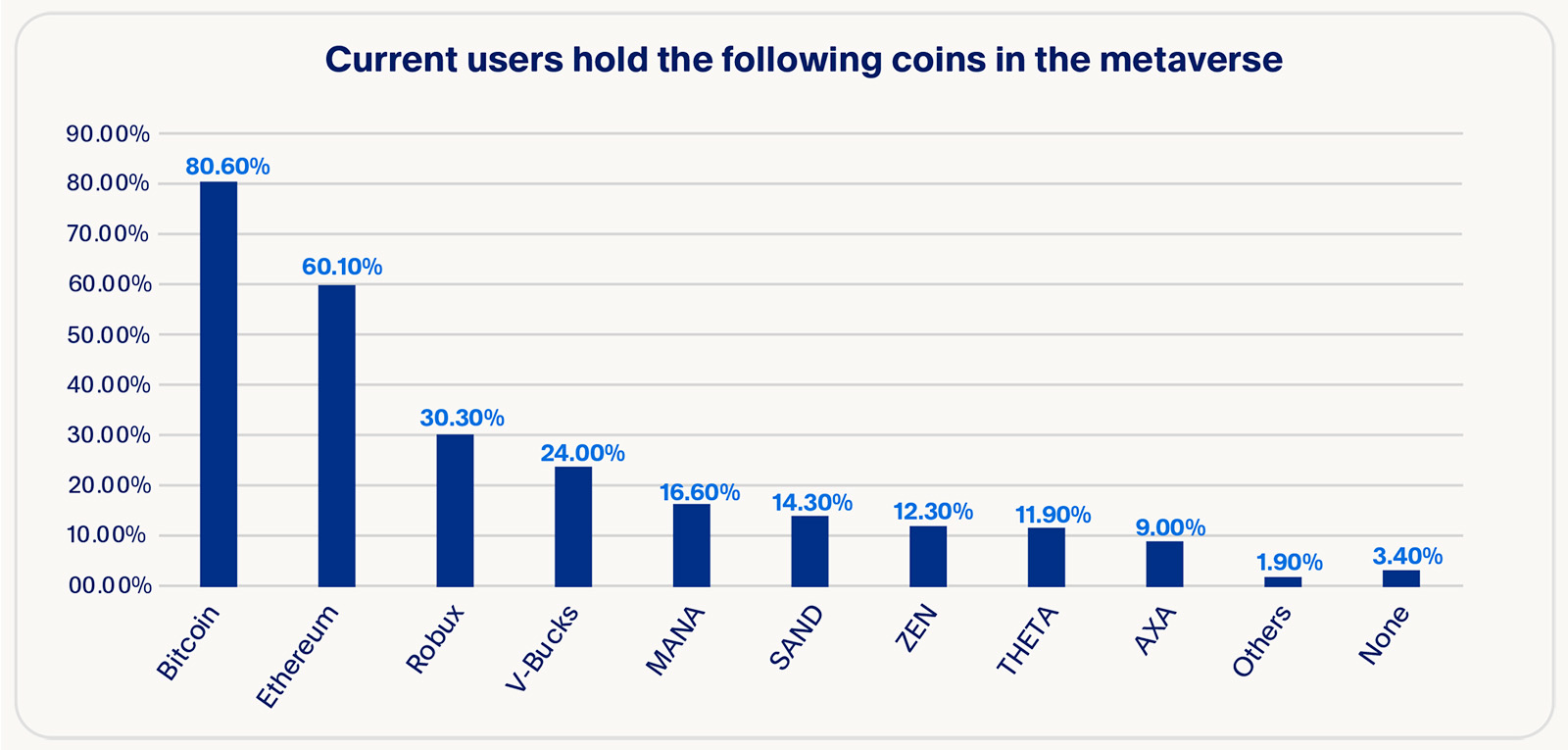

In terms of holding money – defined as “all forms of money and things of value, such as currency, digital currency (e.g., crypto, currency within games like MANA, etc.), and other digital goods you own”-- metaverse users hold a median of $500 and an average of $7,335 in the metaverse. Almost one in three (28%) have more than $1,000 in the metaverse. Over two in five (42%) metaverse users say they have purchased real estate in the metaverse. 97% of metaverse users hold coins in the metaverse. Bitcoin is the most held coin (80.6%), followed by Ethereum (60.1%), and then Robux (30.3%). The number of people who currently hold money in the metaverse is 35.4 million, with a total of $163 billion in value.

Chart 5. Coin Holdings by Current Metaverse Users

Need for Interoperability

Given the large amount of money that is already in the metaverse, and likely expansion in the future, it is important to understand consumer expectations and needs around money management. Consumer insights are essential for understanding what responsible innovation should look like for the future form and function of money in the metaverse.

Currently, metaverse users cannot easily traverse across different platforms with the same avatar. Given the lack of avatar interoperability across different metaverse platforms, it is not surprising that there is a need for interoperability for spending, storing, and receiving money.

When it comes to spending and paying for purchases, a large majority of U.S. respondents want money interoperability across the virtual and physical worlds, without having to convert between U.S. dollars and a cryptocurrency or an in-game token. There is room for improvement and innovation.

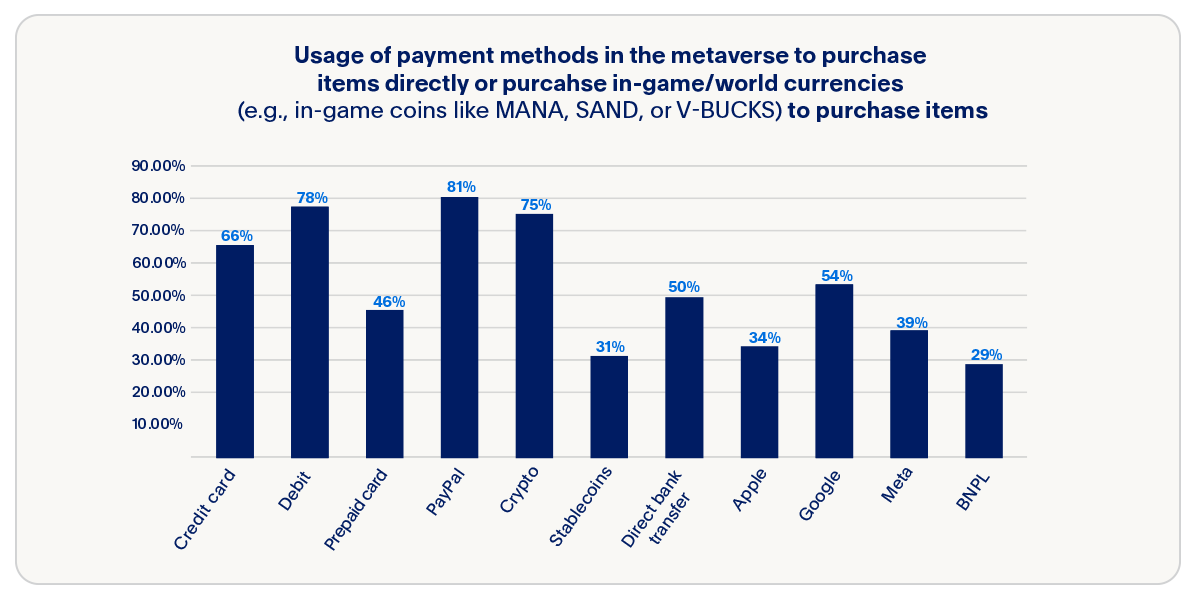

- Metaverse users utilize a variety of payment methods to purchase items in the metaverse, with PayPal as the most common currently used payment method (81%), followed by debit cards (78%), crypto (75%), and credit cards (66%). Interestingly, the pattern of payment methods in the metaverse largely reflects that of e-commerce, with the notable exception that metaverse users use crypto much more widely than e-commerce shoppers, suggesting an appetite for innovation.

- More than half of metaverse users (56%) expect their use of crypto to increase in the next 5 years. A very high percentage of respondents say it is important to be able to use cryptocurrencies (89%) and stablecoins (84%) for purchases in the metaverse.

- 95% of all survey respondents say it is very or somewhat important to be able to make purchases in both the virtual and physical worlds using the same currency, without transferring between a digital currency (e.g., Bitcoin, Ethereum) and USD.

- 91% say the ability to make purchases directly in metaverse worlds without having to first purchase in-world currency/tokens is very or somewhat important to them.

Chart 6. Current Usage of Payment Methods in the Metaverse

The average metaverse user in the survey sample has money stored across 5 different metaverse platforms. 79% of them indicated having digital assets spread across more than one metaverse world. And 93% of all survey respondents – users and non-users alike – say the ability to store all their money and/or digital assets (e.g., skins, NFTs, in-game currency, etc.) they have in the metaverse in a single secure place is very or somewhat important to them.

Moreover, U.S. respondents place a high importance on the capabilities to put money into and take money out of the metaverse. 92% say it is very or somewhat important to be able to put money into the metaverse, and 95% say it is very important to be able to get money out of the metaverse. Moreover, 95% of all survey respondents say it is very or somewhat important to be able to use a common currency across metaverse worlds, and only 53% of users are very satisfied with their ability to do so.

There is strong interest in generating income through activities in the metaverse and they want to get paid in a variety of payment methods, which further underscores the need for money interoperability. 16% of survey respondents say they are currently making money and 75% say they want to do so in the metaverse. Specifically, 84% of survey respondents say they are interested in at least one type of creating activity – creating digital goods to be sold (47%), creating entertainment (46%), creating video games (41%), building things on the blockchain (39%). Moreover, over half of all respondents (56%) said trading/selling digital goods (e.g., skins, clothing, etc.) is something they currently do or want to do, making it the most common type of income-generating activity in the metaverse. 95% of the survey sample believe creating in the metaverse would give them access to buyers they would not have in the real world.

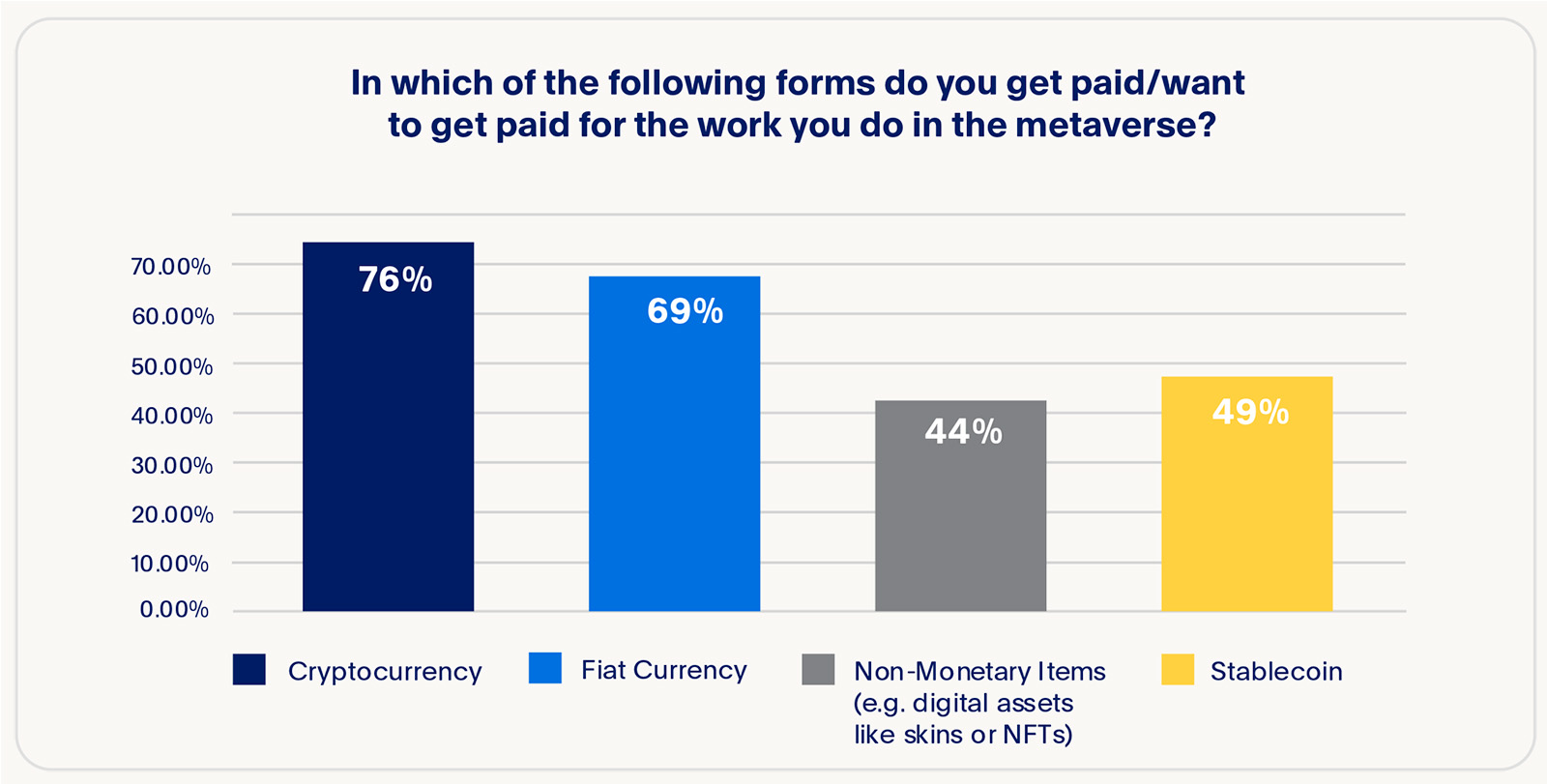

85% of them say they would like to be paid in different methods than they do currently. Notably, even with the fluctuations and downturn in the market, 76% of respondents want to get paid in crypto, more than other forms of money (see Chart 7 below).

Chart 7. Wanted Forms of Payments for Work Done in the Metaverse

Metaverse users do not want their money to be “stuck” in the metaverse; they want to overcome thresholds to access, transfer, and use their money. For money in the metaverse to effectively perform the three core functions of money unit of account, medium of exchange, and store of value), the metaverse financial infrastructure needs to provide three kinds of money interoperability – interoperability across metaverse platforms; interoperability between metaverse platforms and other online environments; interoperability between virtual and physical worlds.

Need for Security

The core tenet of any robust financial infrastructure is trust. And security is a foundational pillar for that trust. Early Internet technology did not have consumer retail applications until encryption technology became available and credit card credentials could be securely tokenized to enable transactions.[AJ1] Similarly, security of assets and money in the metaverse could be another opportunity for innovation.

94% of survey respondents say the ability to insure metaverse payments against fraud is important to them. And 61% worry about the security of the money they have and will have in the metaverse.

A key enabling layer of security and trust for money in the metaverse will be digital identity. 69% of survey respondents say they want to have a single sign-on for different worlds in the metaverse (e.g., one identity and one password). Robust digital identity management has been the cornerstone of digital payments and digital wallets, as it enables fraud detection and management, and the fulfillment of Anti-Money Laundering (AML), Know your Customer (KYC), and other compliance requirements. In the case of the metaverse, digital wallets could extend to enabling avatar verification and interoperability too.

Conclusion

Camera technology has made the images of Yosemite Valley more accessible to more people, but it has continued to attract visitors to see and enjoy the grandeur of nature in real life (“IRL”). One could even argue that enhancements in camera technology have only increased, instead of lessened, the demand for embodied experiences in the physical reality.

What the metaverse will evolve to be and whether it will be as dystopian as described in sci-fi novels remains to be seen. We imagine, though, that the metaverse will be more like the camera; not a wholesale replacement of our physical lives, but a supplement to them.

Money will be a key aspect of whether the metaverse creates utility or yields negative outcomes. There are many ways to innovate now and create an enabling layer that makes for a metaverse in which money can be managed safely and efficiently.

With so much money already present in the metaverse, the time for responsible innovation is now. And now is the time to design for interoperability and security.

Download the report (including Appendix) here

1https://www.economist.com/special-report/2023/03/20/how-digital-gaming-spreads-far-and-wide

2Ball, Matthew. The Metaverse: And How it Will Revolutionize Everything. New York, Liverlight, 2022

3https://www.cnbc.com/2023/01/09/apple-vr-headset-to-launch-this-spring-and-ship-in-the-fall-report.html

4https://www.statista.com/outlook/amo/metaverse/united-statexs

5https://www.mckinsey.com/~/media/mckinsey/business%20functions/marketing%20and%20sales/our%20insights/value%20creation%20in%20the%20metaverse/Value-creation-in-the-metaverse.pdf

6https://www.nbcnews.com/think/opinion/fortnite-s-travis-scott-concert-was-historic-he-s-not-ncna1195686

7https://www.womeningames.org/mobile-games-are-key-to-me-time-for-women-new-research/

8For more details on the methodology, please refer to the Appendix.

9Lanier, Jaron. Dawn of The New Everything: Encounters with Reality and Virtual Reality. New York, Henry Holt and Company, 2017.