How to Confirm Your Tax Information to Accept Goods & Services Payments on Venmo in 2022

Beginning January 1, 2022, the Internal Revenue Service (IRS) introduced new reporting requirements for payments received for goods and services, which will lower the reporting threshold to $600 for the 2022 tax season, from 2021’s threshold of $20,000 and 200 transactions.

Payment note with goods and services toggled ‘on.’

View Image | Download Image

These reporting requirements are only for payments received for a good or service, and do not apply for transactions like splitting the bill or paying back a friend or family member. Customers can choose to send a payment for a good or service by toggling the button at the bottom right of the payment note screen in the Venmo app.

This new threshold will apply to all payment services companies that people in the U.S. may use to accept payments for the sale of goods and services. Under the new requirements, these companies, including Venmo, will provide customers with a 1099-K form if they receive $600 or more in a calendar year for payments received for goods or services. There are certain amounts that may be included on the form that are generally excluded from gross income and therefore are not subject to income tax. These include: Amounts from selling personal items at a loss; Amounts sent as reimbursement; Amounts sent as a gift.

So, for example, if a customer purchased a couch for $1200 and later sold it for $800, this amount would not be subject to income tax. We encourage customers to speak with a tax professional when reviewing their 1099-K forms to determine whether specific amounts are classified as taxable income.

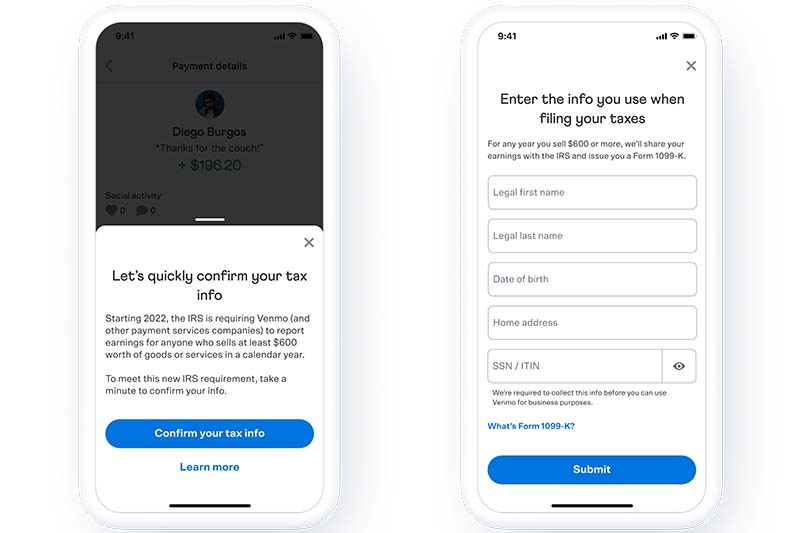

To make sure the Venmo community is prepared for this change, some customers may receive an in-app notification or email in the coming weeks and months, asking to confirm the information they use when filing their taxes. Customers can do this in a couple of quick steps directly from the app, by confirming their name and address and entering their tax information such as their Individual Tax ID Number (ITIN) or Social Security Number (SSN). By providing this information, customers will be able to continue using their Venmo account to seamlessly accept payments for goods and services without any issue in 2022 and beyond.

View Image | Download Image

If a customer plans to use Venmo to receive payments for goods and services in the future, but did not receive a notification, they can also update this information at any time from the Venmo app, by going to Settings, then clicking Tax Verification.

To read more information on the most asked questions about these new requirements, why they are going into effect and who may be impacted, visit our in-depth FAQ here.