Small Business Loans Can be Seen Negatively. New Data Shows the Stigma is Going Away

ProductPayPalInnovationBusiness LendingResearch and Insights

When Hillery Sawyer decided to become an entrepreneur and start Speakcheesy, she didn’t seek out venture capital or put together a well-designed pitch deck. She did what so many entrepreneurs turned small business owners do: they look at their personal finances and figure out how to make it work. It wasn’t for some time that she decided to seek help financing her business. “We didn’t start with a lot of capital. We bootstrapped it. Traditional loans were not an option for me,” she mentioned recently.

This is often the situation for small business owners. They take their idea for a business and figure out how they will finance it to achieve their own “American Dream.”But when the time comes, traditional financing options may be out of reach for a variety of reasons. Traditional financiers typically look at a variety of factors – from credit scores to collateral to high existing debt to low initial capital investment. Additionally, how long the application process takes can be daunting. According to Nerdwallet, the entire SBA lending process can take from 30 days to months for the entire SBA loan process. Unfortunately, this is too long for managing and limited cash flow is one of the key reasons small businesses fail.

This may be the current traditional small business lending way but is this the way it needs to be? Bernardo Martinez, Vice President of Global Merchant Lending at PayPal, doesn’t believe so. “The small business access to capital has been a problem in banking around the world – and COVID-19 has only made it worse. Traditional institutions have tightened their lending requirements – as is typical for economic cycles – and this really ends up hurting small businesses across the board.”

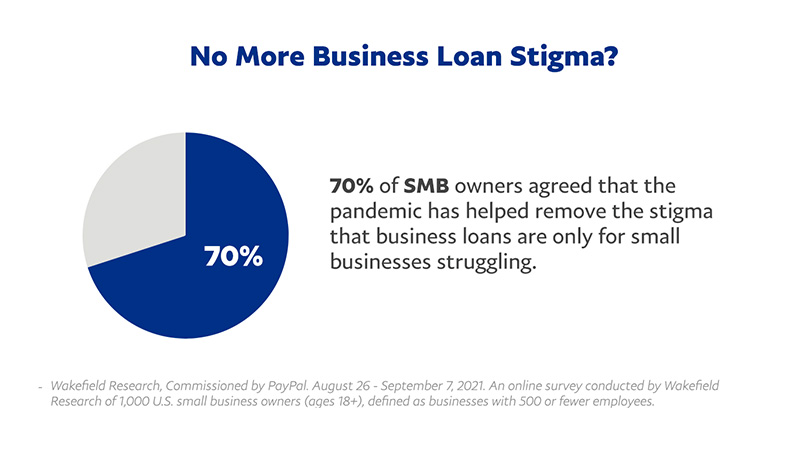

The problem doesn’t lie solely with the lender, however. There are psychological barriers that small businesses, like Hillery’s, face when it comes to financing their dreams. A recent Wakefield Research survey of small business owners found that 26% of Small and Medium-sized Business (SMB) owners would feel embarrassed if friends and family found out that they had applied for a loan. This perceived stigma can be what stands in the way of entrepreneurs achieving their American Dream or struggling to put food on their family’s table.

The Wakefield Research that PayPal commissioned surveyed1 1,000 small business owners over the age of 18 who employed 500 people or fewer and found that while COVID-19 restricted access to capital, it also reduced the perception that taking out a business loan was only for struggling business. In fact, 70% of SMB owners who responded to the survey agreed with this sentiment.

“Cash flow is probably the number one thing small business owners need to manage in order to be successful,” Martinez said. "You can have the best idea in the world, hire the best workers, develop the strongest partnerships with vendors and distributors – but if you can’t manage your balance sheet, you’re never going to be successful.”

The survey shed additional light on small business owners’ expectations and perceptions regarding business financing:

- More than 1 in 3 (37%) SMB owners who responded are expecting to apply for business loans in the year ahead;

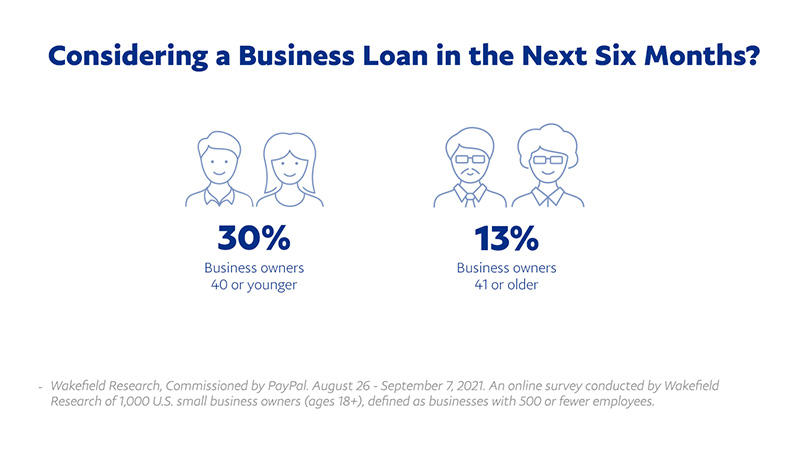

- 73% of SMB owners 41+ who responded don't plan to seek a business loan in the next year. Alternatively, 52% of SMB owners 40 or younger who responded are planning to seek a business loan in the next year;

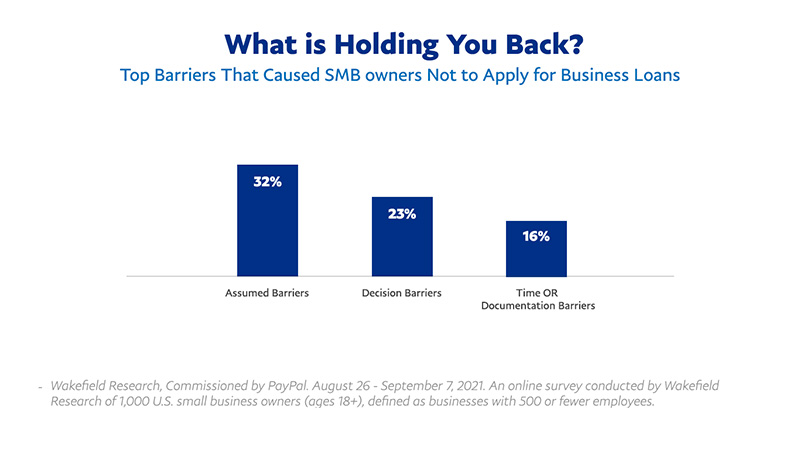

- 32% of SMB owners who responded said they considered applying for a business loan (including government loans) in the past 18 months, but didn’t due to assumed barriers (e.g., didn’t think they would be approved; needed the money sooner than they thought they could get it with a loan);

- 23% of SMB owners who responded reported they considered applying for a business loan (including government loans) in the past 18 months, but didn’t due to decision barriers (e.g. determining how much money to request, deciding where to apply);

- 16% of SMB owners who responded reported they considered applying for a business loan (including government loans) in the past 18 months but didn’t due to time or documentation barriers (e.g., couldn’t find documentation for app; thought they didn’t have time to complete the app)

The data shows that applying for loans to operate one’s business is no longer a negative. It is becoming more needed as 1 in 5 (20%) of SMB owners who responded to the survey are concerned about purchasing new inventory in the coming year. That same percentage (20%) would make further investments in their marketing and product/service offerings if they received a business loan at a good price.

Erica Malbon of Malbon Golf can attest to this sentiment. “Growth is expensive. When we started to see more sales, we needed to ramp up our inventory because we continue to sell out of product,” she mentioned recently. “That’s positive but if you’re missing sales because you don’t have enough inventory, you need to scale up - and that’s where we’ve been able to utilize the capital that PayPal’s provided.”2

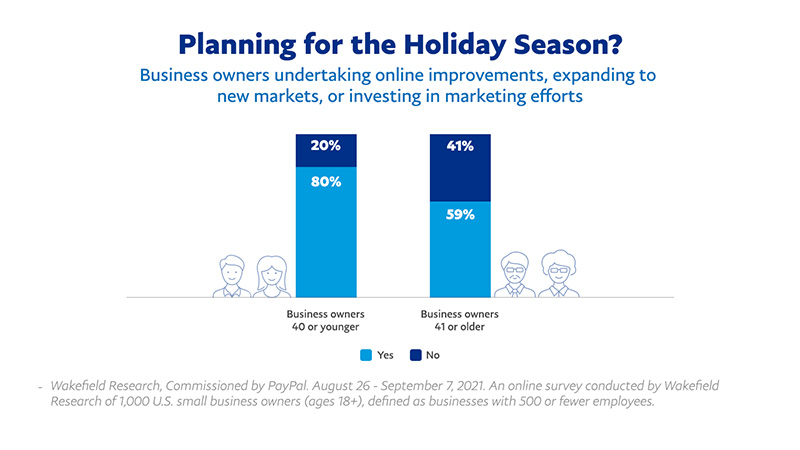

This need to ensure inventory is available and “scaled up”, as Malbon said, is increasingly important as the holiday season approaches. The Wakefield survey also found that 76% of small businesses are expecting this year’s holiday season sales to either be higher than or similar to pre-pandemic. And it’s not just inventory this holiday season, as small business owners are focusing on marketing and advertising (38%), improving their online presence (33%), online advertising or social media (29%), and reaching new customers through different marketplaces (22%).

These plans may necessitate small businesses seek access to funding as soon as possible so they can execute on their plans. Since 2013, PayPal Working Capital and PayPal Business Loan have provided SMBs access to more than $20 billion in funding via more than one million business loans. These business loans offer quick decisions and, when approved, fast funding so they can help small business owners make an impact nearly right away. 60% of PayPal Working Capital borrowers said their business experienced growth after receiving their loan and reported an average of 24% revenue increase. Just as important – and even more so as the holiday shopping season approaches – 77% of those borrowers who experienced growth said the increase occurred within three months.

“Small businesses have big plans this holiday season and need the capital to fund those plans,” Martinez stated. “We’ve offered solutions since 2013 that provide fast access to financing that can have a clearly positive impact on their business.”

1 PayPal Working Capital Growth Study, September 2021

2 The lender for PayPal Working Capital and PayPal Business Loan in the United States is WebBank, Member FDIC.